- AccountsRecovery Daily Digest

- Posts

- Daily Digest - December 17, 2025

Daily Digest - December 17, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy Birthday to: Mickey Kaiser of Corporate Advisory Solutions, and Elizabeth (Libbi) Wilkie of Resurgent Capital Services

🎉Congratulations for starting new positions: Joe Connick as Senior Legal Counsel at National Debt Relief.

🌲 🎅 HOLIDAY HAPPY HOUR - THIS FRIDAY!

I will be hosting a holiday happy hour at 5pm ET on Friday, December 19. All are welcome. Please stop by and enjoy some holiday cheer with your friends and colleagues from across the industry. Reply to this email (or send a separate email to [email protected]) to be added to the calendar invite and get zoom credentials. Hope to see you there!

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Court Grants Plaintiff Nearly $28K in FCRA Case

A District Court judge in Minnesota has awarded a plaintiff more than $27,000 in a Fair Credit Reporting Act case over information that was furnished to the plaintiff’s credit report that predated him moving to the United States and obtaining a Social Security number. The ruling offers a detailed look at how courts view fee disputes, mixed-file issues, and the obligations of furnishers and consumer reporting agencies when a consumer’s identity information changes.

A MESSAGE FROM TCN

TODAY‘S WEBINAR

UPCOMING WEBINARS

Court Says Delay Did Not Equal Waiver in Arbitration Fight

The Court of Appeals for the Third Circuit has overturned a lower court’s ruling that had denied a defendant’s motion to compel arbitration because it had litigated the case for too long before playing the arbitration card. In doing so, the appellate panel provided a significant clarification on what conduct actually amounts to a waiver of arbitration rights in a class action, and how futility interacts with waiver when a defendant cannot yet compel arbitration of unnamed class members.

Affordability Crunch Deepens as Consumers Cut Back on Health Care, Travel, and Everyday Spending

Americans are experiencing significant financial strain across nearly every major spending category, according to a new national survey conducted by Public First and published by Politico. The findings highlight mounting affordability challenges that are affecting health care decisions, travel plans, and day-to-day budgeting.

Judge Dismisses FDCPA Suit After Plaintiff Claims Student Loans Were ‘Discharged’

One of the conditions for a debt to be subject to the Fair Debt Collection Practices Act requires that the debt be in default. But what constitutes a loan being in default isn’t always black or white. A District Court judge in Hawaii has granted a defendant’s motion to dismiss claims it violated the FDCPA and other statutes over demands made by the plaintiff to discharge the debts. The ruling stems from a dispute involving federally serviced student loans and a series of administrative-style notices the plaintiff argued had extinguished the debt.

23 Companies Seeking Collection Talent

While there are fewer than two dozen companies listed in this week's job listing summary, there are nearly 50 positions that are being promoted. Hiring does not appear to be slowing down as we head into the holiday season.

WORTH NOTING: is facing felony charges after phoning in a bomb threat to a Pennsylvania collection agency last month ... If you are looking to buy a new car now, here is how to cash in ... While a lot of people are expecting 2026 to be better for their wallet than this year, most aren't making financial-related resolutions ... Banks are increasing the penalties for overdrafting your account or bouncing checks ... M&A activity in the healthcare sector is expected to ramp up further next year ... Even good people can justify bending the rules at work sometimes .... This would make an awesome April Fool's story ... A list of the best movies and TV from 2025.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

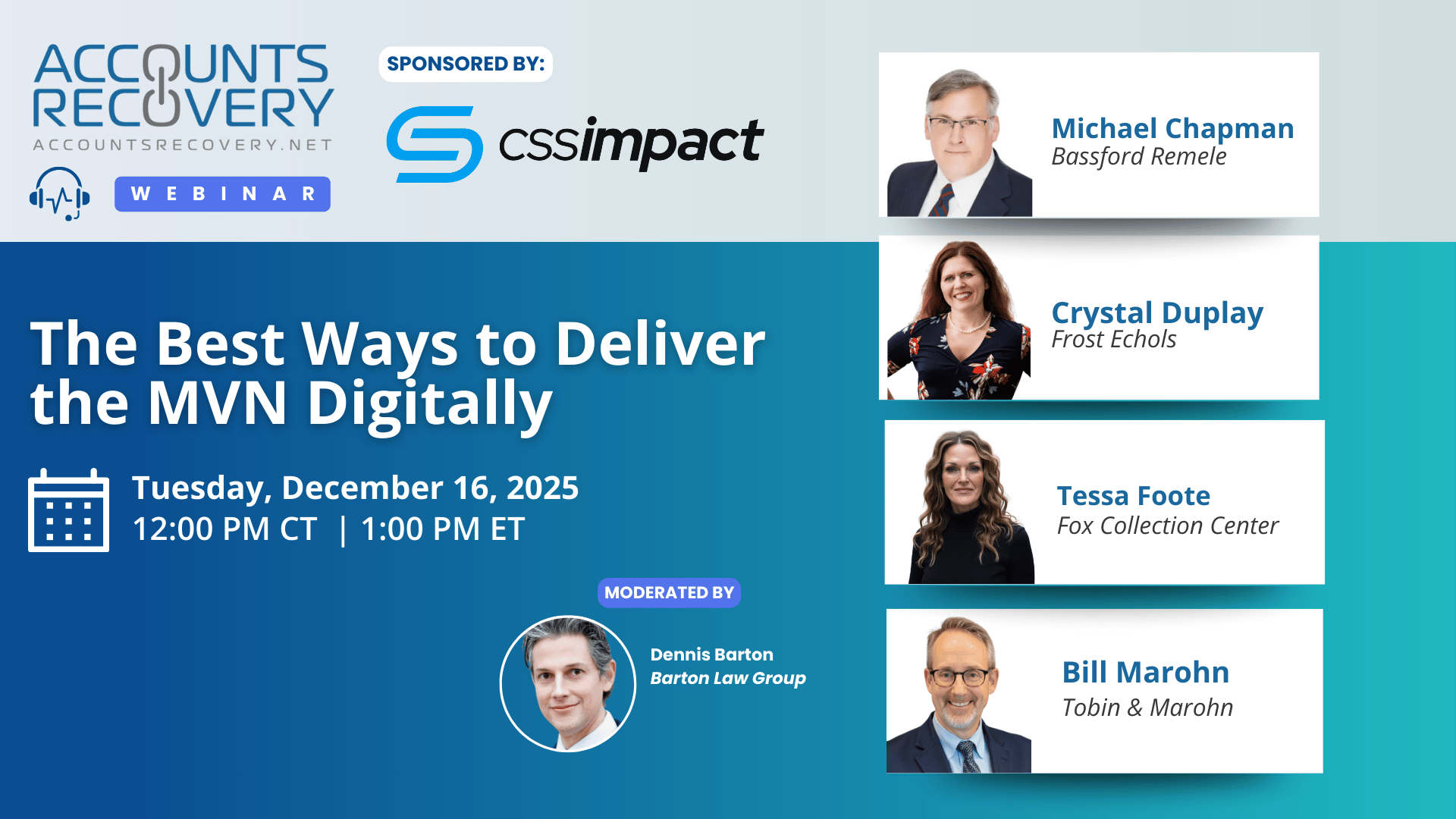

Webinar Recap: The Best Ways to Deliver the MVN Digitally

As digital communication becomes the default channel for consumer engagement, the credit and collections industry continues to grapple with how to deliver the Model Validation Notice (MVN) compliantly outside of traditional mail. In this webinar, a panel of experienced compliance and defense attorneys explored what it truly means to deliver the MVN digitally—and where agencies, law firms, and creditors can easily create risk.

A central theme echoed throughout the discussion was simple but critical: “Don’t mess with the model validation notice.” While email, text, portals, and other non-paper workflows may be permissible, the panel emphasized that digital delivery does not change the substance of compliance obligations under the FDCPA, Regulation F, TCPA, e-sign rules, or state law overlays. In many cases, it increases scrutiny.

Panelists stressed that digital MVN delivery works best when it is the first communication with the consumer and when the collector can rely on pass-through consent from the creditor. Attempts to get creative—whether through formatting changes, attachments, subject lines designed to drive engagement, or added documentation—were consistently flagged as unnecessary litigation risks.

The discussion also highlighted operational considerations that are often overlooked, including opt-out requirements, time-of-day restrictions, consent revocation, and how tracking data (such as link clicks) can become a double-edged sword in litigation. While large-scale cases targeting digital MVN delivery have not yet materialized, panelists agreed that enforcement and class action activity are likely inevitable as adoption increases.

Ultimately, the webinar reinforced that digital MVN delivery should be treated as a compliance initiative—not a cost-saving shortcut or engagement tactic.

🧠 Key Takeaways:

Confirm consent and timing before going digital. Digital MVNs are safest when sent as the first communication using creditor-provided contact data with valid pass-through consent.

Preserve the MVN exactly as issued. Avoid formatting changes, added language, attachments, or creative presentation that could invite scrutiny.

Plan for operational and litigation impact. Ensure clear opt-outs, proper time-zone controls, and documented procedures for handling replies, bounces, and tracking data.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN