- AccountsRecovery Daily Digest

- Posts

- Daily Digest - December 16, 2025

Daily Digest - December 16, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy Birthday to: Michael Lamm of Corporate Advisory Solutions, Dennis Jefferson of Spero Financial, and Lisa Rogers of Citi.

🎉Congratulations for starting new positions: Kiersten Bateman as Collections Team Lead at Cherry, Luis A Chacon Monterrosa as Collections Operations Manager at Felix, and Gene Thomas as Vice President of Sales at Solvent+.

🌲 🎅 HOLIDAY HAPPY HOUR - THIS FRIDAY!

I will be hosting a holiday happy hour at 5pm ET on Friday, December 19. All are welcome. Please stop by and enjoy some holiday cheer with your friends and colleagues from across the industry. Reply to this email (or send a separate email to [email protected]) to be added to the calendar invite and get zoom credentials. Hope to see you there!

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Collector Facing FDCPA Class Action for Communicating After Receiving Cease Request

So much about compliance isn’t black or white, it’s subjective. Take, for example, how much time should you have to accommodate a cease communication request from a consumer. A plaintiff in Florida has filed a class-action lawsuit, alleging a collection operation violated the Fair Debt Collection Practices Act because it did not honor the cease communication request that he sent fast enough.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

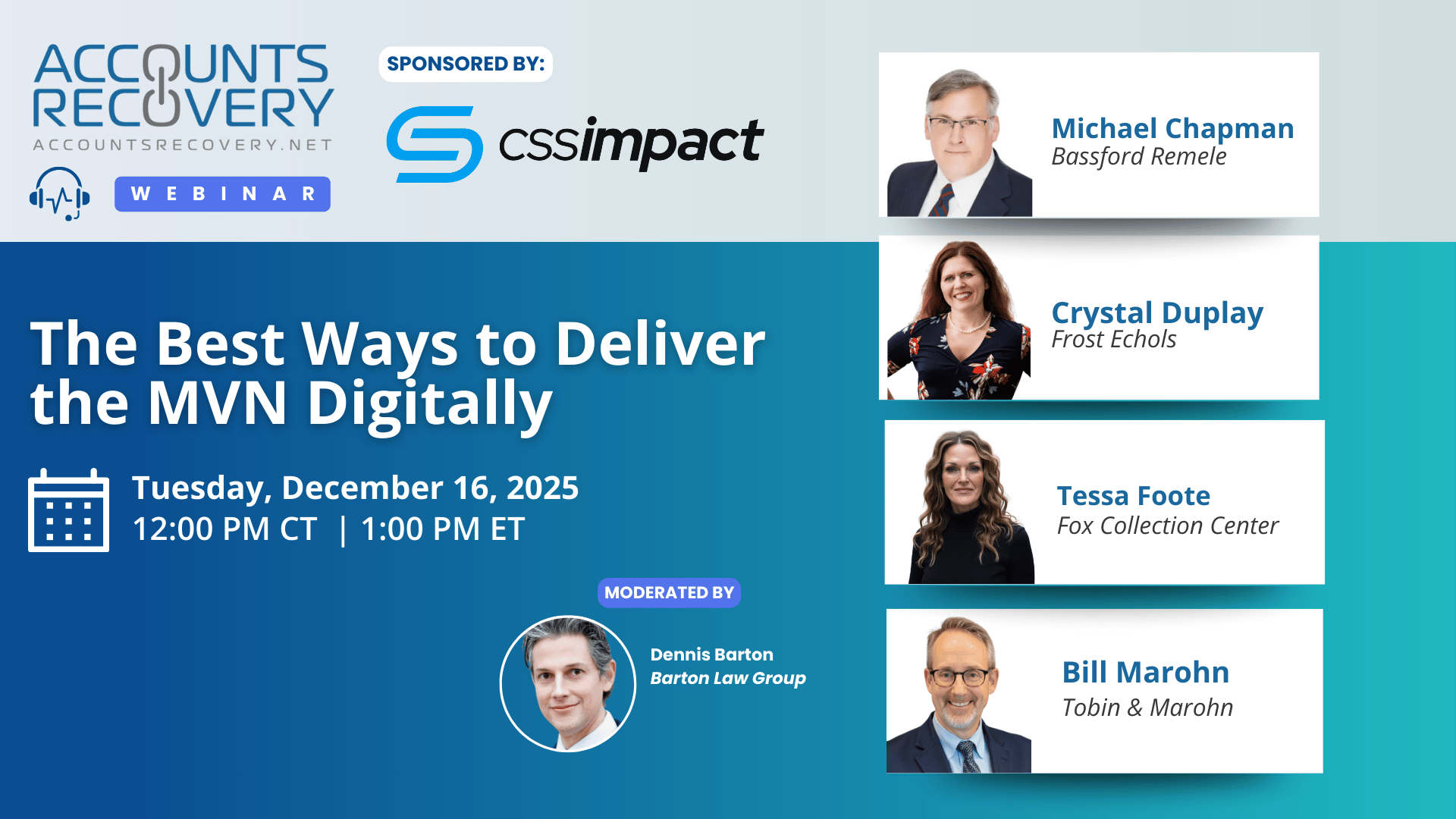

TODAY‘S WEBINAR

UPCOMING WEBINARS

Florida Supreme Court Expands Protection for Joint Spousal Accounts in Garnishment Disputes

The Supreme Court of Florida has clarified state law over whether an account, which was opened by one individual and then changed to a joint account, can be subject to a garnishment owed by the individual who was added to the account.

Judge Dismisses FCRA and FDCPA Claims Over Credit Reporting Dispute

A District Court judge in Virginia has granted a defendant’s motion to dismiss claims it violated the Fair Credit Reporting Act and the Fair Debt Collection Practices Act over how a debt was being reported to the credit reporting agencies, concluding the plaintiff failed to allege sufficient facts to support any of the violations he asserted.

New Report Shows Why Student Loan Borrowers Are Disengaging, and What Might Bring Them Back

A new report from the Community Service Society of New York highlights the disconnect between student loan borrowers and the repayment system, identifying widespread confusion, a lack of financial literacy, and deep mistrust that continue to fuel delinquency and default among millions of Americans.

Consumers Still Prefer Simplicity at Checkout, New Study Finds

A new global survey from Transaction Network Services underscores a message that the credit and collection industry cannot afford to ignore. Despite rapid advances in digital wallets, agentic commerce and self-service technologies, consumers in the U.S., UK and Australia still prefer the simplest path when paying for goods and services.

WORTH NOTING: It has nothing to do with pigs, but "slop" is your word of the year ... People are expecting 2026 to be worse financially, which is not a good sign ... Cybersecurity experts share their 2026 predictions ...More evidence of just how bad the healthcare system is for many people in this country ... Whether you have heard of it or not, why you need to be aware of and concerned about shadow AI ... A good chunk of people across the country expect to spend at least the next six months paying off their holiday-related credit card debt ... Do you agree with these choices for the worst Christmas movie ever? ... The CEO of McDonald's has some blunt career advice for you.

Trailer Tuesday, part I

Trailer Tuesday, Part II

Webinar Recap: Engineering Consumer Trust: Designing Digital Journeys That Feel Fair

The recent webinar highlighted how organizations across financial services, collections, and healthcare can strengthen consumer trust by embedding fairness into digital experiences. Panelists emphasized that trust is not only a regulatory requirement but also a strategic advantage in an increasingly digital-first environment.

Speakers from FinTech, banks, and collections technology firms discussed how consumers judge institutions by their experiences rather than intentions. One panelist noted: “Fairness isn’t a feature—it’s the foundation of trust.” The conversation explored how transparency, empathy, and responsible use of technology can transform repayment journeys into opportunities for building loyalty.

Key themes included the importance of clear communication, explainable AI, and proactive compliance integration. Panelists warned against “black box” systems that erode confidence, stressing that digital journeys must be intuitive, respectful, and aligned with consumer expectations.

🧠 Key Takeaways:

Audit and Simplify Digital Touchpoints: Review portals, apps, and communication channels to ensure clarity and fairness. Consumers should easily understand their rights, obligations, and available options.

Embed Transparency and Empathy: Provide clear explanations of processes and fees, while training staff and designing systems to reflect compassion. As one speaker said: “Consumers don’t judge us by our intentions, they judge us by their experiences.”

Leverage Technology Responsibly: Use analytics and automation to personalize journeys, but ensure AI systems are explainable and compliant. Responsible data use builds trust while reducing bias.

The message is clear: fairness-driven digital design is not optional—it is essential for sustainable success and stronger consumer relationships.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN