- AccountsRecovery Daily Digest

- Posts

- Daily Digest - December 15, 2025

Daily Digest - December 15, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy Birthday to: Cara Anderson of VoApps, Carla Polito of Kompato AI, Robert Morris of Oliphant, and Bob Welsh. Happy belated Birthday to Noel Crichton of Crown Asset Management (Dec. 14), Tyler Beets of Revco Solutins (Dec. 14), Matthew Hamilton of Servicing Solutions (Dec. 13), and Ryan Henderson of CCMR3 (Dec. 13).

🌲 🎅 HOLIDAY HAPPY HOUR - THIS FRIDAY!

I will be hosting a holiday happy hour at 5pm ET on Friday, December 19. All are welcome. Please stop by and enjoy some holiday cheer with your friends and colleagues from across the industry. Reply to this email (or send a separate email to [email protected]) to be added to the calendar invite and get zoom credentials. Hope to see you there!

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Court Rejects Pro Se Plaintiff’s Bid to Revive FCRA Suit Against Credit Bureaus

A District Court judge in Ohio has granted a defendant’s motion to convert the dismissal of a Fair Credit Reporting Act case to one with prejudice while also denying a motion from the plaintiff, who was representing herself, to vacate the dismissal and reinstate her claims against the three credit reporting agencies.

A MESSAGE FROM TCN

TODAY‘S WEBINAR

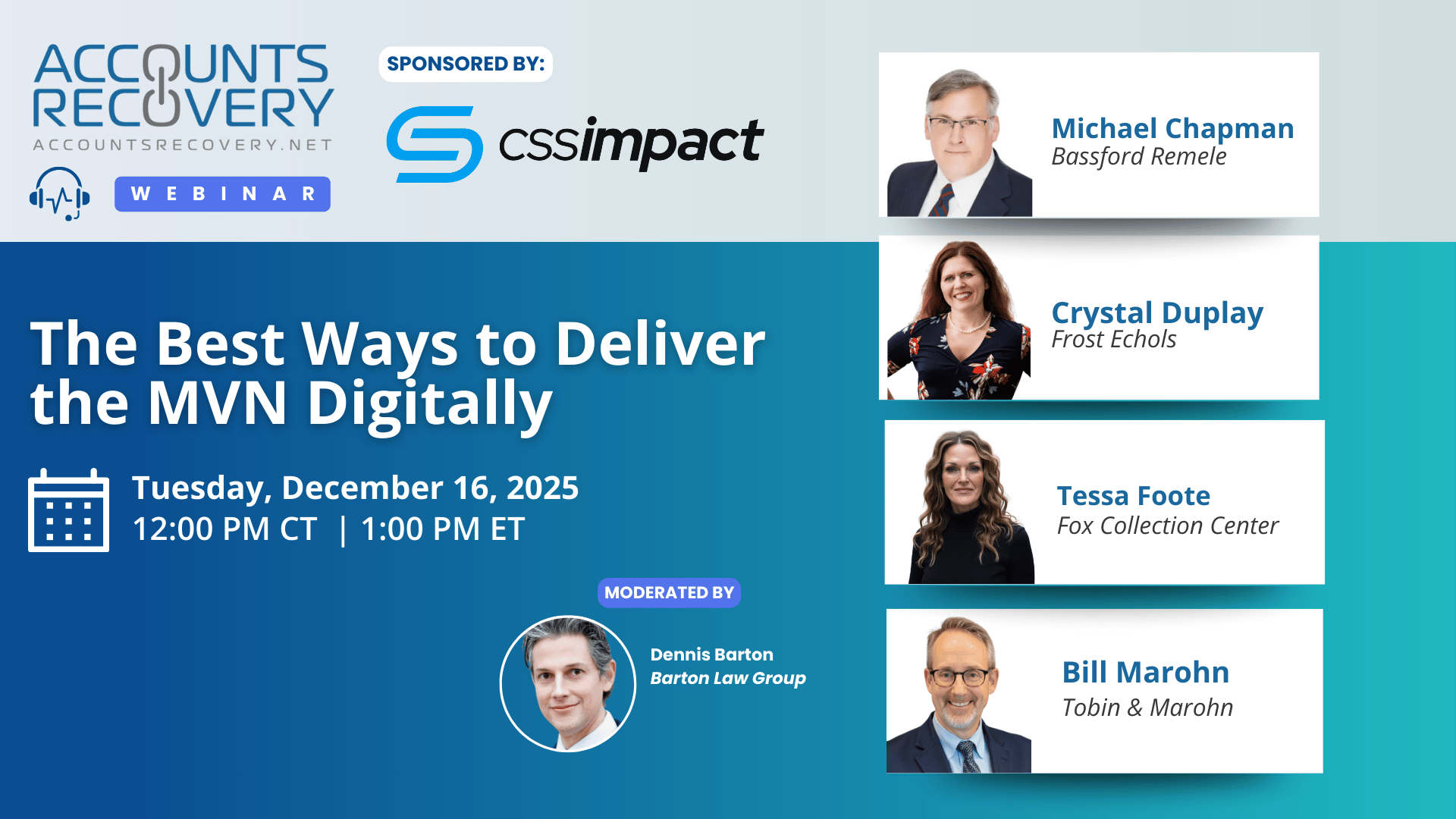

UPCOMING WEBINARS

Study: Nearly 40% of Surgery Patients Face Financial Hardship

Nearly 40% of adults who undergo surgery in the United States experience significant financial hardship in the year that follows, according to research published in JAMA Surgery. The findings add another data point to the intensifying conversation around medical debt, underinsurance, and the financial fragility of patients — an issue that directly affects healthcare providers and the ARM industry.

Trump AI Order Sparks Showdown With States Over Regulation

President Trump’s new executive order aimed at superseding state artificial intelligence laws is already creating political, legal and operational ripple effects. For the credit and collection industry, which is quickly adopting AI tools for consumer engagement, compliance and analytics, this fight will shape the rules everyone must play by.

Sovereign Citizen Theories Strike Out Again in Minnesota FDCPA Case

What is the batting average on sovereign citizen cases? I mean, even a blind squirrel finds a nut every now and then, but it seems like the squirrel has better luck than anyone trying sovereign citizen arguments. A District Cout judge in Minnesota has dismissed a Fair Debt Collection Practices Act lawsuit after a plaintiff demanded $150,000 because the plaintiff did not provide an adequate accounting of his finances in order to avoid paying the filing fees.

Compliance Digest – December 15

Insights from eight different legal experts -- Stefanie Jackman, Leslie Bender, Michael Chapman, David Schultz, Mitch Williamson, Loraine Lyons, Cooper Walker, and Jeff Topor -- on recent court rulings and legal updates to help you understand what is going on in the compliance side of the industry.

This series is sponsored by Bedard Law Group

WORTH NOTING: Six cities where the housing market is going to boom next year ... States where the mininum wage is going to go up on January 1 ... If you argue with your kids about screentime, you are not alone ... Why we love chain restaurants ... When snow shoveling goes from routine to risky ... The top 100 photos of 2025 ... How much it costs to leave cookies out for Santa ...How to differentiate between boredom and burnout.

Music Monday, part I

Music Monday, Part II

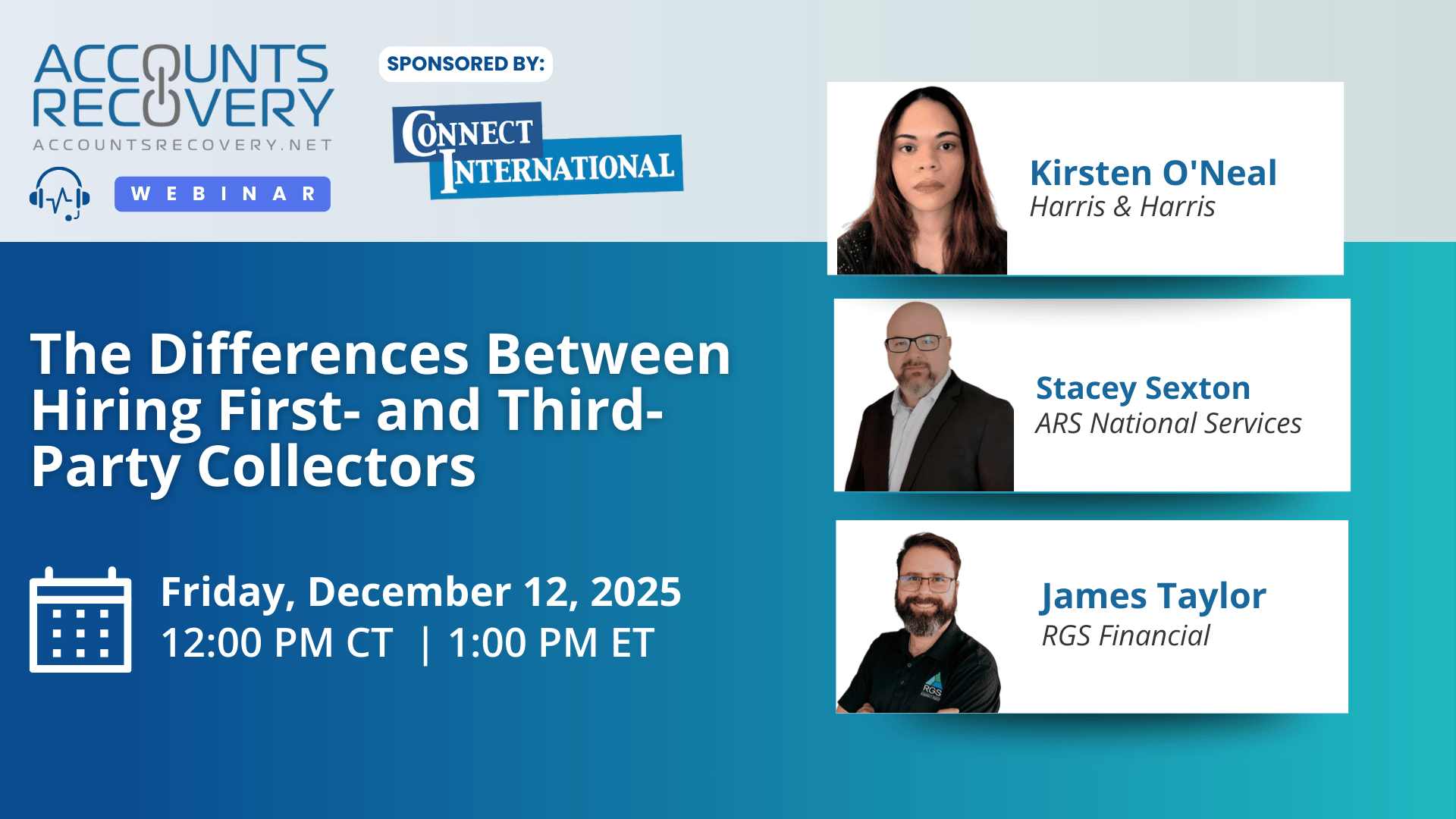

Webinar Recap: The Differences Between Hiring First- and Third-Party Collectors

In this webinar, the panel of experts examined why hiring for first-party and third-party collection roles requires distinctly different approaches—even though both aim to resolve unpaid debt. Moderated by Mike Gibb and sponsored by Connect International, the discussion highlighted how treating these roles as interchangeable often leads to underperformance, higher attrition, and missed revenue opportunities.

Panelists emphasized that first-party collections typically demand strong customer service skills, empathy, and adherence to structured repayment options designed to protect brand reputation. In contrast, third-party collections require assertiveness, negotiation ability, creativity, and a tolerance for ambiguity, as collectors often work older, charged-off accounts with fewer predefined solutions. As one panelist noted, third-party collectors must be able to answer the consumer’s question: “Why should I pay you?”

The conversation also explored practical hiring strategies, including behavioral interviews, role-play scenarios, and identifying transferable skills from industries such as retail, food service, auto sales, and enforcement roles. Panelists cautioned against overreliance on predictive assessments, noting that top performers frequently score poorly on standardized tests. Instead, they advocated for human judgment, video pre-screens, and faster hiring timelines to avoid losing strong candidates in a competitive labor market.

Remote versus onsite hiring was another key theme, with panelists agreeing that remote roles require higher levels of self-motivation and experience, while newer collectors benefit from onsite training and organic learning. Ultimately, the discussion reinforced that successful hiring depends on aligning motivation, skill set, and temperament with the specific demands of each collection model.

🧠 Key Takeaways:

Differentiate roles clearly: Align interview questions, role plays, and compensation discussions with the distinct demands of first-party versus third-party collections.

Hire for grit and communication: Skills can be trained, but resilience, confidence, and conversational ability are harder to teach and critical for success.

Keep humans in the decision loop: Use technology and assessments as tools, not gatekeepers, and move quickly to secure strong candidates.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN