- AccountsRecovery Daily Digest

- Posts

- Daily Digest - December 12, 2025

Daily Digest - December 12, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy Birthday to: Angela Lewis of Frost-Arnett Company.

🎉 Congratulations for starting new positions: Kasandra Ramirez as Collections Manager II at Cherry, and Ethan Barnett as Collections Manager II at Cherry.

🚨New Training Bytes Video Released!

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Christopher Nye from Radius Global Solutions shares how collectors should handle consumers who want to negotiate but refuse to give a reason why they can’t pay the full amount? Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

🌲 🎅 HOLIDAY HAPPY HOUR - FRIDAY, DECEMBER 19

I will be hosting a holiday happy hour at 5pm ET on Friday, December 19. All are welcome. Please stop by and enjoy some holiday cheer with your friends and colleagues from across the industry. Reply to this email (or send a separate email to [email protected]) to be added to the calendar invite and get zoom credentials. Hope to see you there!

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Suit Accuses Collector of Sending Text, Emails at Inconvenient Time

This one is a slightly different spin on the trend of cases from consumers who attempt to limit the times or channels where it is convenient to be contacted by a collector. A collection operation is facing claims it violated the Fair Debt Collection Practices Act because it sent a text message and “numerous” emails during a time when the plaintiff had informed the defendant that it was inconvenient to be contacts.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

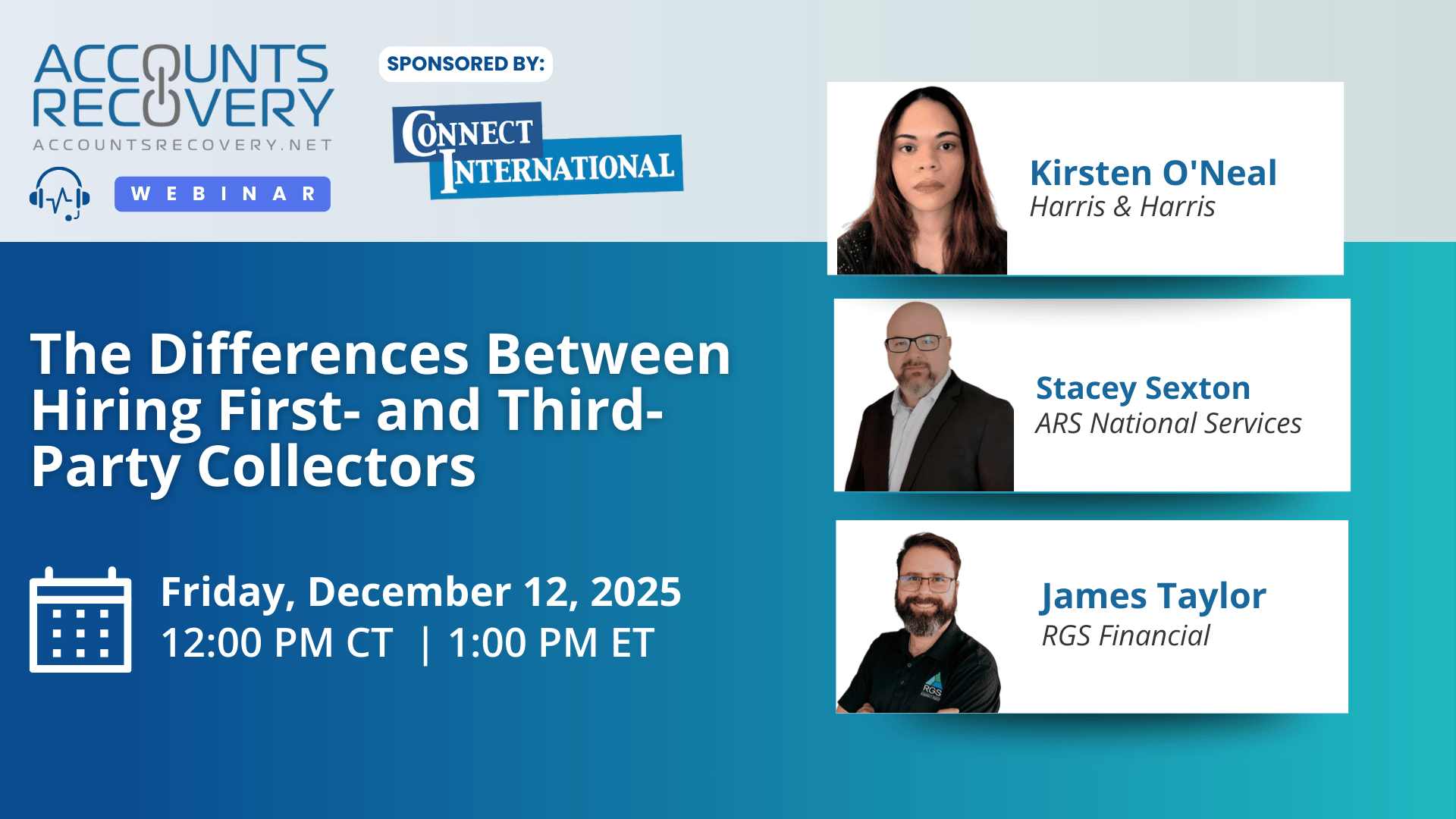

TODAY‘S WEBINAR

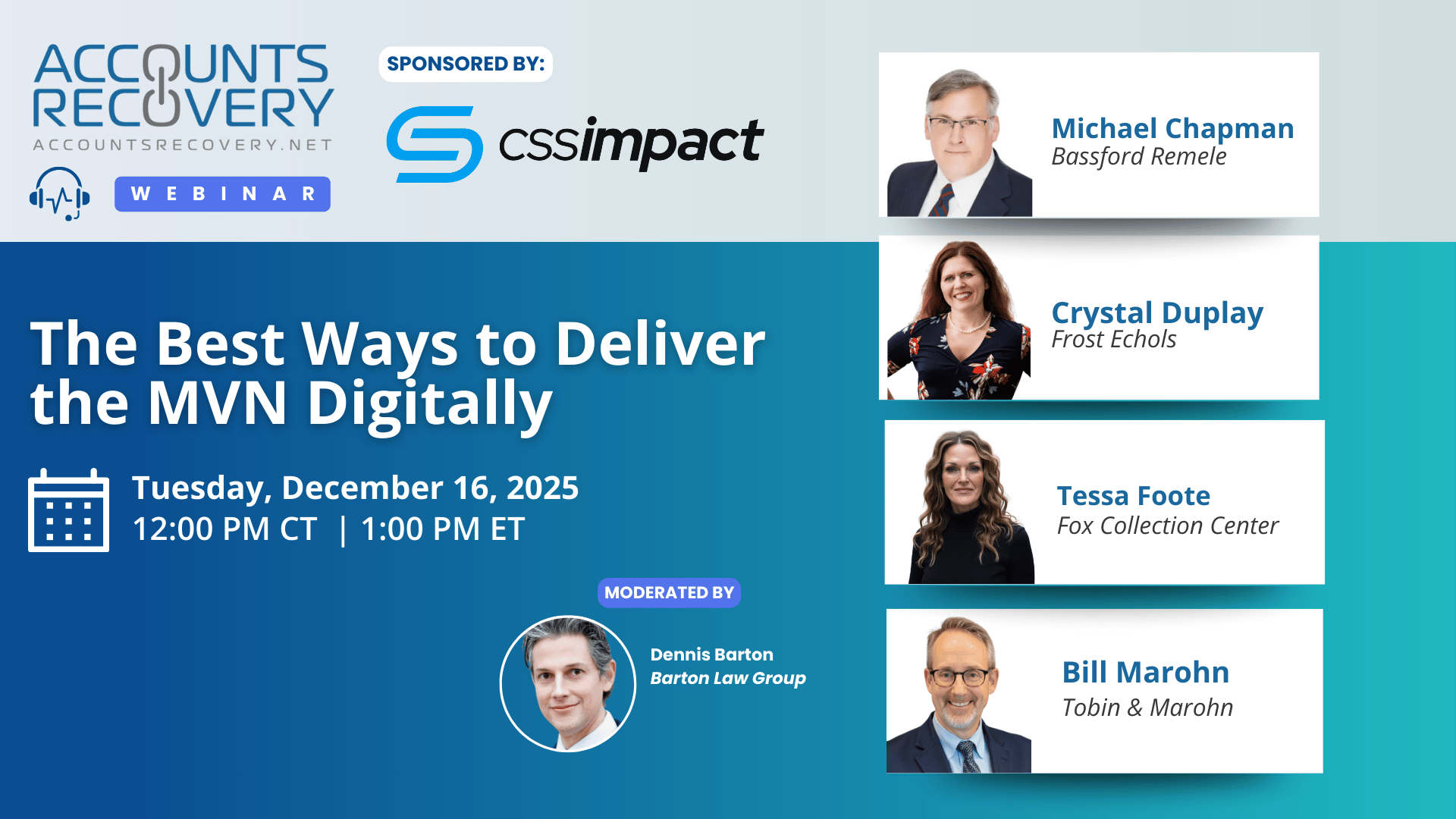

UPCOMING WEBINARS

FTC Data Shows Unwanted Calls Still Down Sharply Since 2021, Even as Complaints Tick Up

The Federal Trade Commission yesterday released its National Do Not Call Registry Data Book for Fiscal Year 2025, offering one of the clearest annual snapshots of how consumers are managing inbound call preferences. For an industry that engages with consumers primarily by phone, the trends are impossible to ignore.

Judge Dismisses FDCPA Suit Challenging Email Offer and Tradeline Language

A District Court judge in California has granted a defendant’s motion to dismiss a lawsuit claiming it violated the Fair Debt Collection Practices Act, for, among other reasons, indicating what would happen to the tradeline on the consumer’s credit report if the account was satisfied.

FCRA Dispute Moves Forward After Borrowers Claim Payments Were Returned, Not Late

A Magistrate Court judge in Kentucky has denied a motion to dismiss filed by a bank that is being accused of violating the Fair Credit Reporting Act because the bank allegedly failed to correct reporting that the plaintiffs were late on their mortgage payments after returning payments back to the plaintiffs.

Medical Debt Lawsuits by Community Health Centers Draw Scrutiny and Industry Pushback

A recent ProPublica investigation is fueling] conversation about how medical debts are pursued by community health centers, which are facilities specifically designed to serve low-income and uninsured patients. The report highlights instances where federally qualified health centers (FQHCs) have sued patients, garnished wages, and engaged third-party collectors, raising difficult questions about the balance between mission and financial sustainability.

WORTH NOTING: how healthcare can win over or win back the American people ... Details about the new version of ChatGPT that came out this week ... The average FinTok (the financial side of TikTok) user spent more than 400 hours scrolling their feed in 2025 ... Five dozen stocking stuffer ideas for kids ... Marketing tricks not to fall for during the holiday season ... This story just keeps getting weirder and weirder ... The best movie performances of 2025 ... Fans and flyers of Southwest Airlines might be happy to read this.

Funny Friday, part I

Funny Friday, Part II

Webinar Recap: What is 'Intelligent Payment Orchestration' and Why Should You Care?

In a recent webinar hosted by Mike Gibb and sponsored by Authvia, industry leaders explored the growing importance of Intelligent Payment Orchestration (IPO) in collections and financial services. Panelists Scott Hamilton (ARM Tech Advisors), Trevor Rubel (Authvia), and Dave Bader (Mission Lane) highlighted how IPO integrates multiple processors, payment methods, and rules to optimize transaction success, reduce costs, and improve consumer experience.

Scott Hamilton noted, “I always thought it was one transaction goes down one pipe… but the more I learned, the more sophisticated the last mile is in collections.” Trevor Rubel compared IPO to the evolution of self-driving cars, emphasizing that orchestration is not a single product but a layered journey. Dave Bader underscored the operational impact: “It’s a real shame to go through all that hard work to get a payment, and then something fails on the back end.”

The discussion revealed that many agencies believe they operate with one processor but often juggle multiple due to legacy portfolios or acquisitions. Without orchestration, this creates inefficiencies and missed opportunities. Tools such as account updater, network tokens, and retry logic can significantly improve approval rates, reduce declines, and lower costs. Beyond efficiency, IPO enables consumer-friendly strategies like wallet integration and flexible micro-payment plans, transforming the way agencies engage debtors.

🧠 Key Takeaways:

Evaluate multiprocessor capabilities: Move beyond single-threaded setups to platforms that intelligently route transactions for higher approval rates and lower costs.

Adopt tools like account updater and network tokens: These reduce failed transactions, automatically update expired cards, and can boost approval rates by 2–5%.

Enhance consumer experience with flexible payment options: Integrate digital wallets and conversational payment solutions to reduce friction and enable micro or tailored payment plans.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN