- AccountsRecovery Daily Digest

- Posts

- Daily Digest - December 11, 2025

Daily Digest - December 11, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy Birthday to: Leo C. Stawiarski, Jr. of LCS Receivables Management, and Susan Turner Littleton of MicroBilt.

🎉 Congratulations for starting new positions: Shirley Mason as Sales Executive at Salud Revenue Partners.

🌲 🎅 HOLIDAY HAPPY HOUR - FRIDAY, DECEMBER 12

I will be hosting a holiday happy hour at 5pm ET on Friday, December 12. All are welcome. Please stop by and enjoy some holiday cheer with your friends and colleagues from across the industry. Reply to this email (or send a separate email to [email protected]) to be added to the calendar invite and get zoom credentials. Hope to see you there!

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Getting to Know John Trotta of RTR Financial Services

Is there better proof that John Trotta loves to deep dive than the fact that everything he has learned to become the CTO of a collection operation was learned on the job? Not only was RTR Financial Services his first exposure to the credit and collections industry, but his first exposure to tech, too. Living his best advice of never stop learning has helped John in his career. Read on to learn more about John, why he’s not doing much reading these days, and why knows so much about hops.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

TODAY‘S WEBINAR

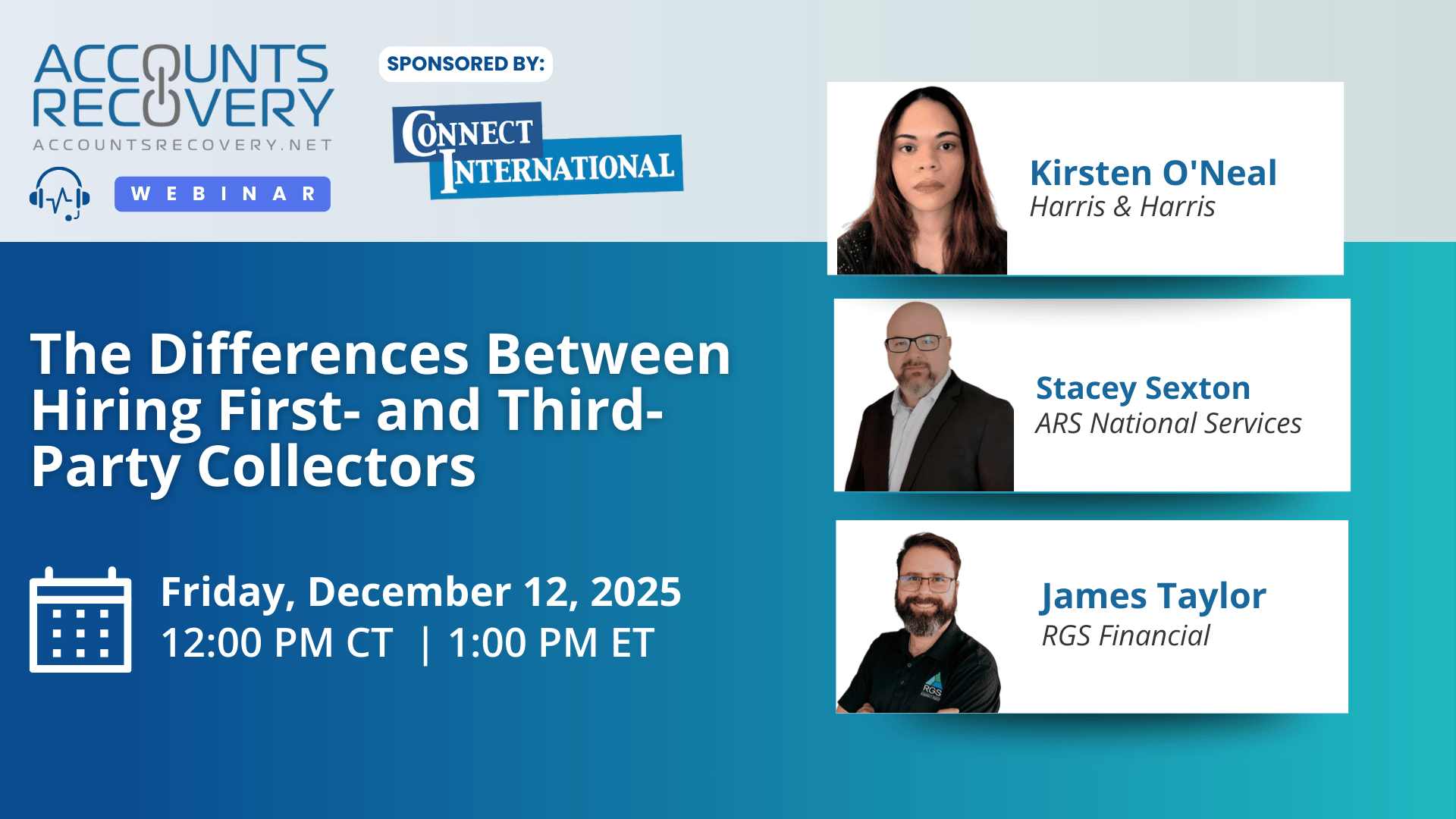

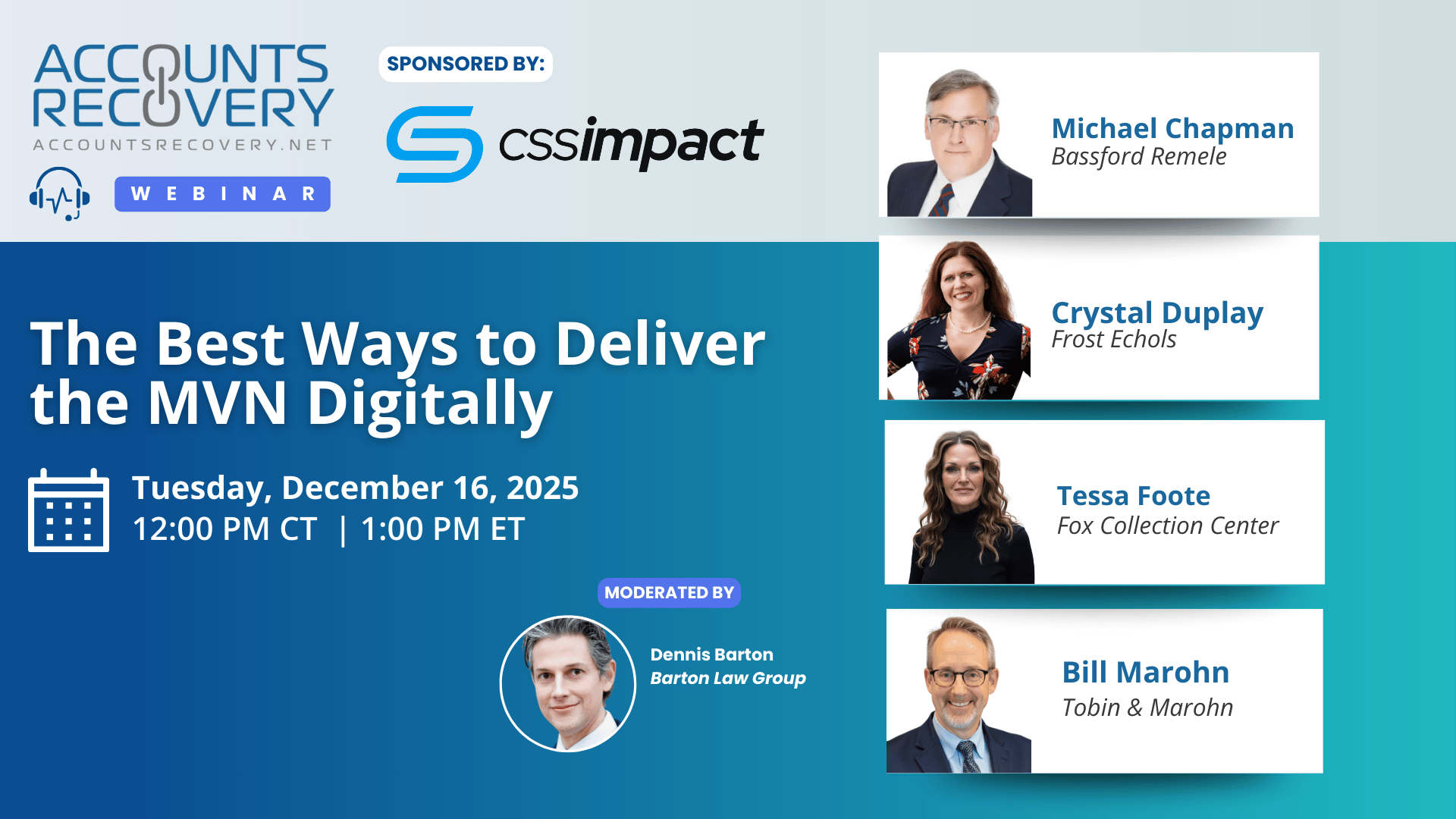

UPCOMING WEBINARS

Judge Tosses FDCPA Class Action Over Eviction Fee

A District Court judge in Illinois has granted a defendant’s motion to dismiss a Fair Debt Collection Practices Act class-action lawsuit over a fee that was assessed during eviction proceedings, because the fee was explicitly referenced in the underlying community association agreement.

GAO Denies Protest From Collector Over Debt Collection Contracting Decision

The Government Accountability Office has denied a protest that was filed by a collection operation over how the Treasury Department awarded contracts to five different collection companies to collect tax debts owed to the government.

Judge Grants MTD in FCRA and FDCPA Suit Over Alleged False Affidavit of Service

A District Court judge in Maryland has granted a defendant’s motion to dismiss claims it violated the Fair Credit Reporting Act and the Fair Debt Collection Practices Act, as well as a motion seeking sanctions against the defendant, over allegations that the defendant knowingly submitted a false affidavit of service in a collection lawsuit filed against the plaintiff.

More Hospitals Automate Charity Care Screening to Avoid Bad Debt

More hospitals are moving to technology-driven, front-end screenings that automatically identify patients who qualify for charity care, according to new outreach from Undue Medical Debt. The shift reflects the growing pressure on health systems to support uninsured and underinsured patients while managing rising uncompensated care costs.

WORTH NOTING: words describing financial planners' clients' feelings about 2026: caution, uncertain, and optimistic. Can anyone say, "mixed bag"? ... TransUnion is projecting the smallest year-over-year growth in credit card balances in more than a decade for next year ... Secretary of State Marco Rubio has made the Calibri font the latest battlefront in the war against DEI ... A survey that details how the affordability crisis is hitting the working class ... Why young people are struggling to communicate ... A guide on how to spot AI-written content ... Nobody really needed this to believe it, but here's another survey that shows just how overwhelmed moms are today ... A spike in the cost of natural gas may cause more people problems keeping their houses warm this winter.

Top 10 Thursday, part I

Top 10 Thursday, Part II

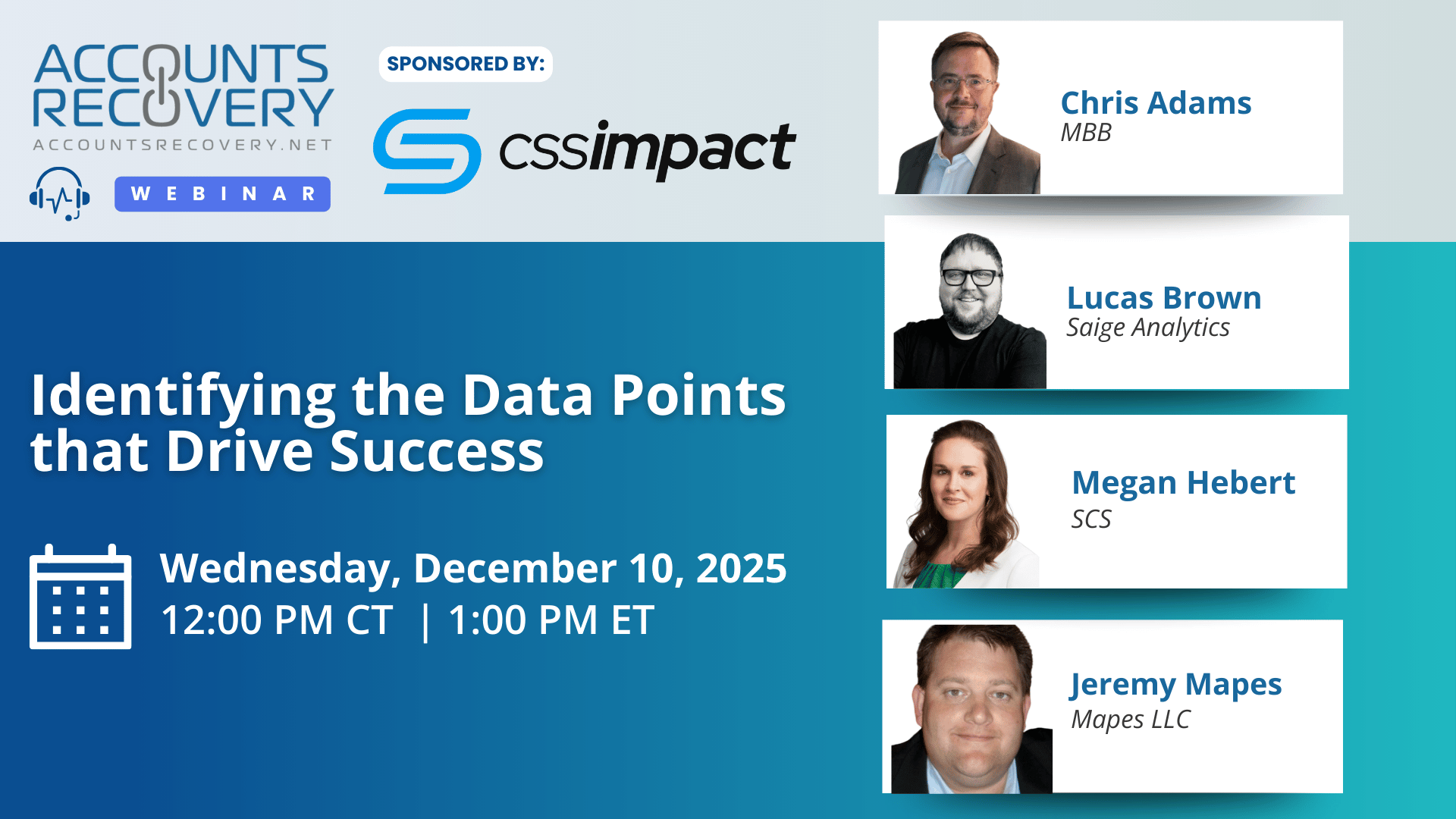

Webinar Recap: Identifying the Data Points that Drive Success

In a webinar sponsored by CSS Impact, panelists Chris Adams, Lucas Brown, Megan Hebert, and Jeremy Mapes joined moderator Mike Gibb to break down the core data elements that meaningfully influence performance across credit and collections operations. While every agency generates large amounts of data, the panel emphasized that success comes from knowing which data points matter—and how to interpret them.

A central theme of the discussion was the importance of trending rather than reacting to individual daily numbers. As Lucas Brown noted, “A number means nothing unless you know how it compares to yesterday or last week.” Panelists agreed that foundational KPIs—placements, engagement, outreach volume, right-party contacts, and payments—remain the most reliable indicators of operational health when evaluated over time.

Attribution emerged as a persistent industry challenge. Hebert advocated embedding “Easter eggs” such as tagged URLs or unique inbound numbers to identify which communications drive portal visits or inbound activity. Mapes reinforced that even basic differentiation—different numbers for letters, texts, emails, or skip tracing—can reveal actionable patterns.

Panelists also underscored the value of internal historical behavior. Adams noted that agencies frequently overlook their most powerful data: “We’ve already seen this person—how they paid us before should inform how we engage them now.” Internal propensity-to-pay insights, they argued, often outperform external models.

Finally, the group pointed to AI as a transformative tool for accelerating analysis, enabling agencies of all sizes to process complex datasets and uncover insights faster than ever before.

🧠 Key Takeaways:

Track trends, not snapshots. Evaluate placements, engagement, and payment activity against prior days, weeks, and months before making strategic changes.

Strengthen attribution. Use tagged links, channel-specific inbound numbers, and communication identifiers to understand exactly what drives consumer action.

Leverage internal history. Prior payment behavior and past engagement patterns offer immediate, high-value insight into future recovery potential.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN