- AccountsRecovery Daily Digest

- Posts

- Daily Digest - December 10, 2025

Daily Digest - December 10, 2025

Brought to you by: TCN | By Mike Gibb

🎂 Happy birthday to: Tony Weir of Finvi, William A Douglas of Citizens, Stephen Ornstein of Alston & Bird, and Brian Breheim of IC System.

New Speakers Being Added Daily

Check out ARMTech.live for the growing list of impressive speakers who are going to be in Dallas. This is going to be the must-attend event of the year!

Missed Deposition Opportunities Sink Motion to Reopen Discovery in FDCPA Case

A Magistrate Court judge in Utah has denied a motion from the defendants in a Fair Debt Collection Practices Act case to re-open discovery so they can depose the plaintiff, ruling that the defendants “were not diligent in pursuing” the deposition when they had the chance.

A MESSAGE FROM TCN

TODAY‘S WEBINAR

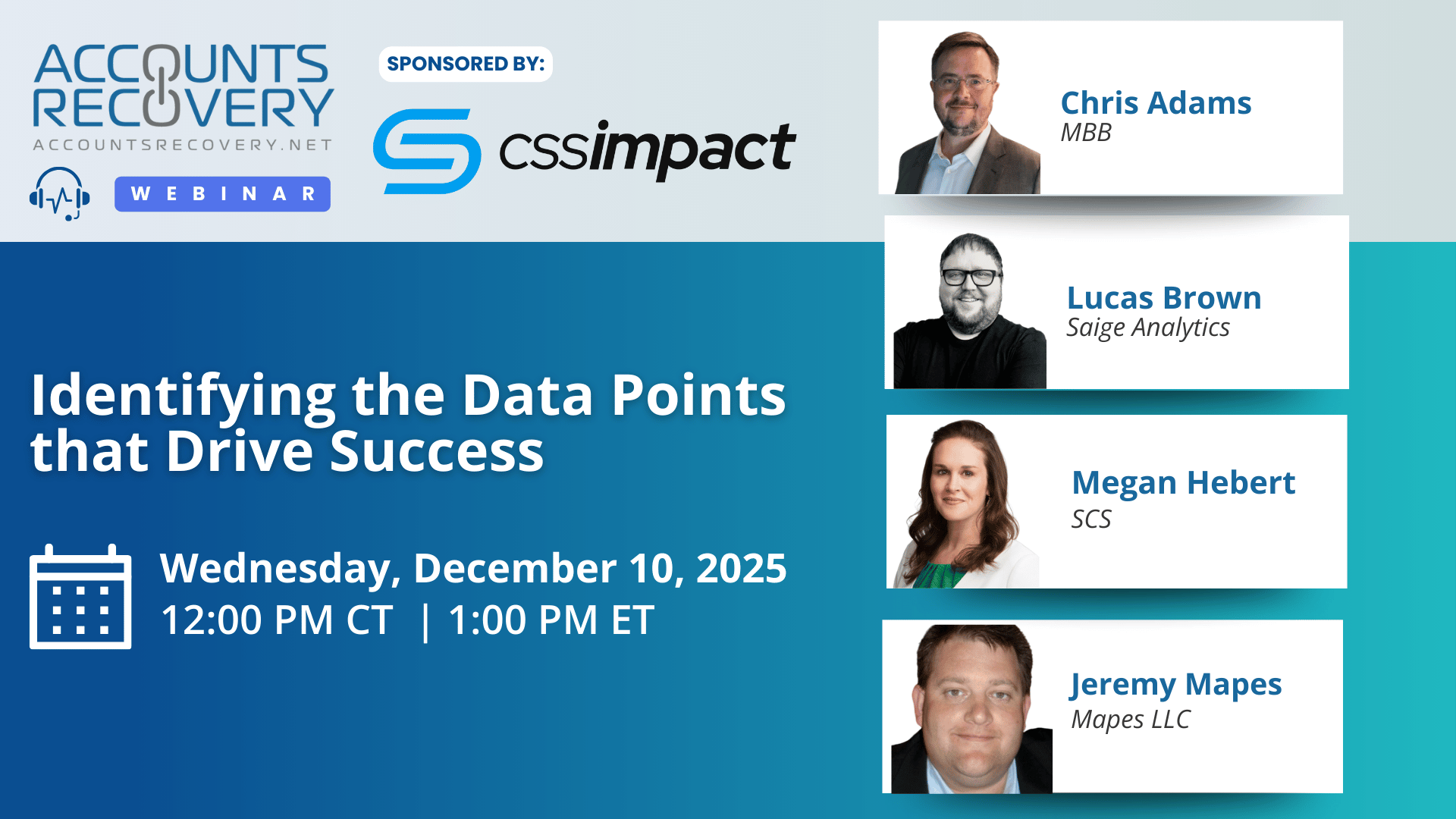

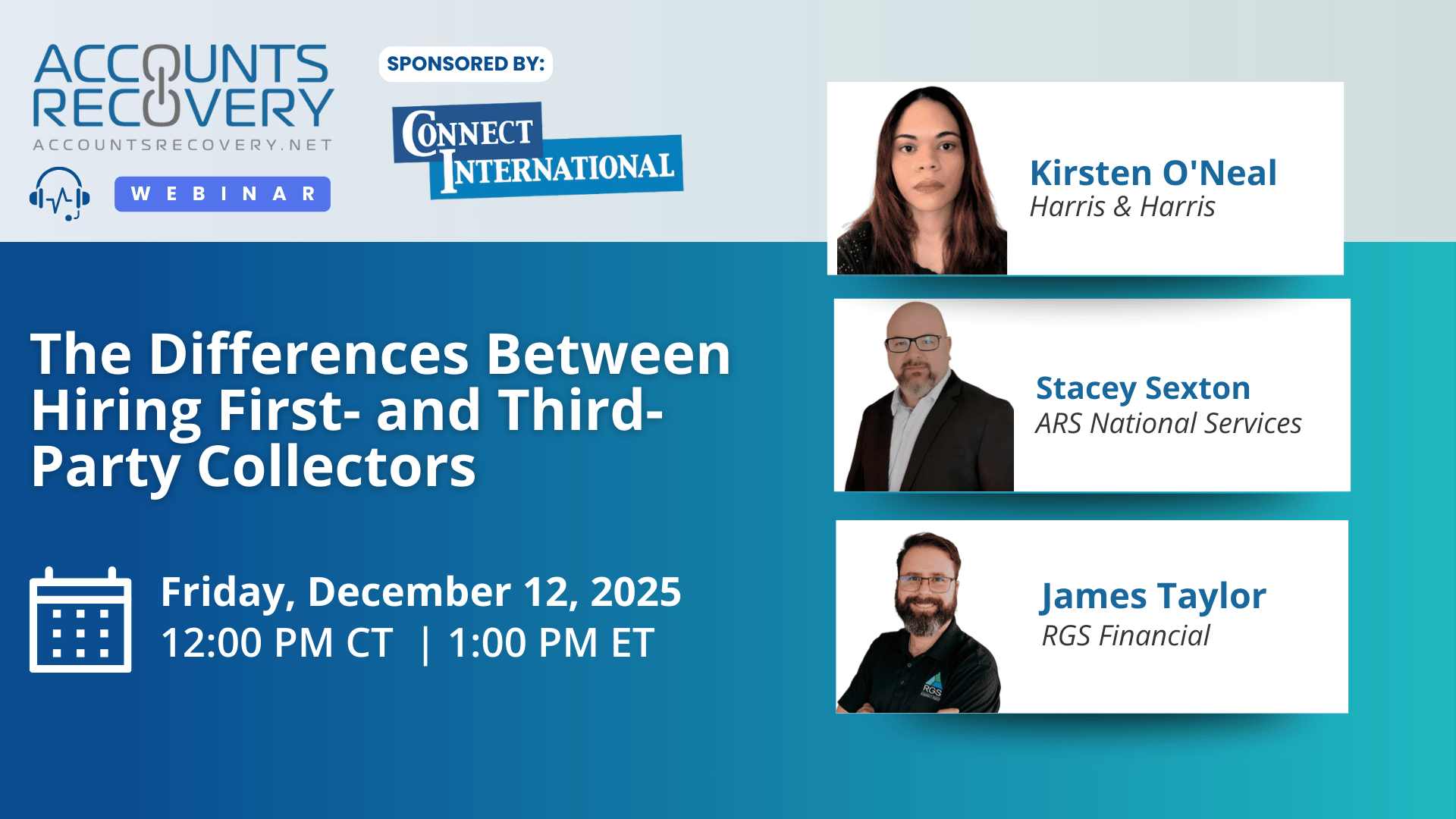

UPCOMING WEBINARS

Medical Debt Protection Act Introduced in Massachusetts Legislature

A bill has been introduced in the Massachusetts legislature that updates and amalgamates a series of bills related to medical debt collection. The legislation would create sweeping new rules that directly affect how medical debts can be collected, reported, sold, and enforced in the state.

New Data Shows Student Loan Delinquencies Surging Above Pre Pandemic Levels

A new analysis from the JPMorgan Chase Institute points to an unexpected driver behind the jump in overdue student loan payments and raises important questions for collection professionals as the Department of Education prepares to resume wage garnishment on defaulted federal loans.

Court Rejects SOL Bid in Indiana FCRA Case

A District Court judge in Indiana has denied a defendant’s motion to dismiss claims it violated the Fair Credit Reporting Act, ruling that the five-sentence complaint that was originally filed in state court was done so within the two-year statute of limitations, even though the defendant was never served and the case was not pursued until 18 months later, when an amended complaint was filed.

40 Companies Seeking Collection Talent

Curious which collection operation is looking for digital agents? Or which one wants a new manager of operations? Or which creditor is looking for a collections department manager? Get the answers to those questions and 37 more companies looking for collection-related help in this week's job listing summary

WORTH NOTING: Young people don't like to give gifts that need to be wrapped; they prefer digital presents ... How Indiana became one of the best teams in college football by practicing less ... New data shows where inflation is hitting consumers the hardest ... How artificial intelligence can help health care providers turn themselves into the next Netflix or Amazon ... Why we have two nostrils instead of one big hole ... Leftover hacks are exploding on social media ... A four-word trick to saying a great goodbye ... A study analyzed 38 million obituaries to answer what makes a life well lived?

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

Webinar Recap: What Ops Leaders Wish Compliance Understood — and What Compliance Wishes Ops Understood

In this webinar, industry experts explored the long-standing friction—and growing collaboration—between operations and compliance teams in collection organizations. Panelists emphasized that while both functions aim for better results, reduced risk, and stronger consumer experiences, miscommunication and conflicting assumptions often create unnecessary tension. As one panelist noted, “It’s not a matter of if you get sued, but when,” underscoring why alignment is essential.

The discussion highlighted how the relationship between operations and compliance has evolved from the historically adversarial “traffic cop” dynamic to a more cooperative partnership. Panelists described how organizations increasingly recognize compliance as a strategic asset that prevents lawsuits, strengthens culture, and supports long-term profitability. Still, challenges remain, especially when operational teams seek speed or efficiency in “gray areas,” while compliance officers push for tighter adherence to statutory definitions and documentation.

Training emerged as a central theme. Speakers argued that collectors are capable of understanding compliance when training is practical, transparent, and anchored in “the why.” Providing real call examples, explaining audit criteria, and tying compliance directly to incentive structures help collectors stay engaged and accountable. Panelists also stressed the importance of bringing compliance into client conversations, updating procedures collaboratively, and documenting decisions thoroughly—particularly when leadership declines compliance recommendations.

When asked how to calculate the ROI of compliance, panelists pointed to avoided litigation costs, business continuity, and client trust. As one expert put it, compliance is not an obstacle to revenue—it is “revenue preservation.”

🧠 Key Takeaways:

Integrate compliance early in planning. Include compliance staff in operational decisions, technology reviews, and client conversations to prevent rework and reduce risk.

Build practical, transparent compliance training. Use real examples, explain audit scoring, and show collectors how compliance directly affects bonuses and defensibility.

Strengthen documentation and update procedures collaboratively. Replace back-and-forth edits with working sessions, root-cause analysis, and clear ownership of procedure accuracy.

Did you know you can get full access to all of my past webinars, along with transcripts and summaries of each, for only $29/month? Sign up to be a premium subscriber today!

The Daily Digest is sponsored by TCN