- AccountsRecovery Daily Digest

- Posts

- Daily Digest - August 8, 2025

Daily Digest - August 8, 2025

Brought to you by: TCN | By Mike Gibb

🎂🎁 Happy Birthday to: Jim Beck of MRS BPO, Shriket Pai of Rausch Sturm,

🎉 Congratulations to Thomas Von Eschen for starting new position as Manager, Consumer Loan Servicing at SchoolsFirst Federal Credit Union.

New Training Bytes Video Published

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Ryan Thorpe from FFAM breaks down what a collector should say when a consumer says, “What are you going to do about this? You can’t do anything to me.” Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

August Meeting Schedule

Check out the upcoming meetings for August and note there are two new meetings — one to discuss collection platforms/software, and one for vendors to meet. Click on the link for each to register.

August 13 - Small Agency TechTactics

August 14 - Women in Collections

August 19 - Vendor Roundtable

August 19 - ARMTech Innovation Lab

August 21 - Compliance Chat

August 26 - Platform Pulse

Prevent a target from being put on your back. Attend Compliance-Con and learn from the experts.

Suit Accuses Creditor of Pulling Credit Without Permission

Mixed messages. Nuance. Intent. The challenges of understanding what someone means in a text message is not easy. It should be, because you can use all the words in the English language to describe your intention and what you want, but as we all know, when it comes to texting, most people don’t use all the words in the English language. And things can escalate quickly. A creditor is facing claims it violated the Fair Credit Reporting Act by accessing an individual’s credit report without her permission, alleging that when she texted she would “reach out another time,” that meant their business was concluded.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

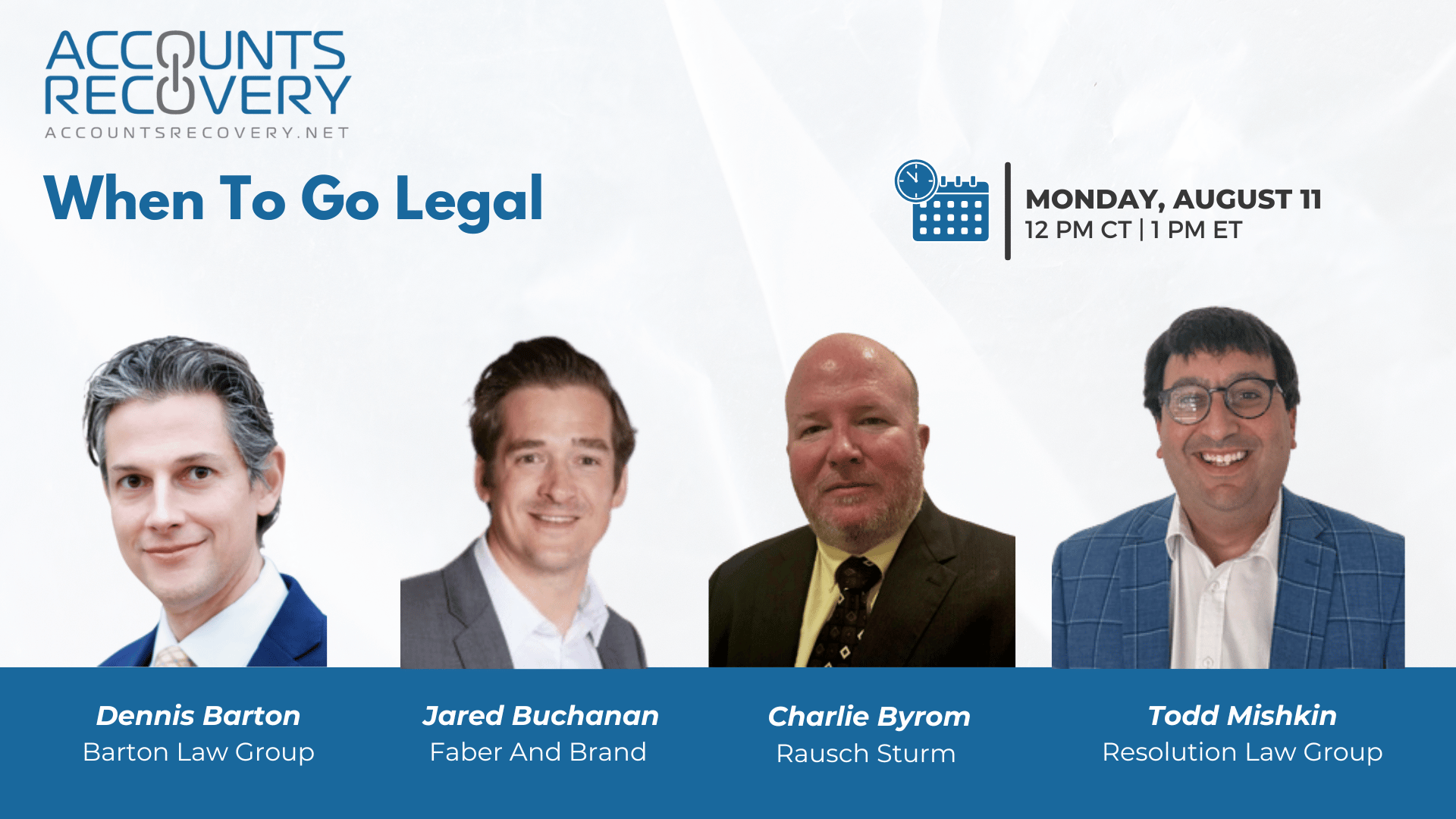

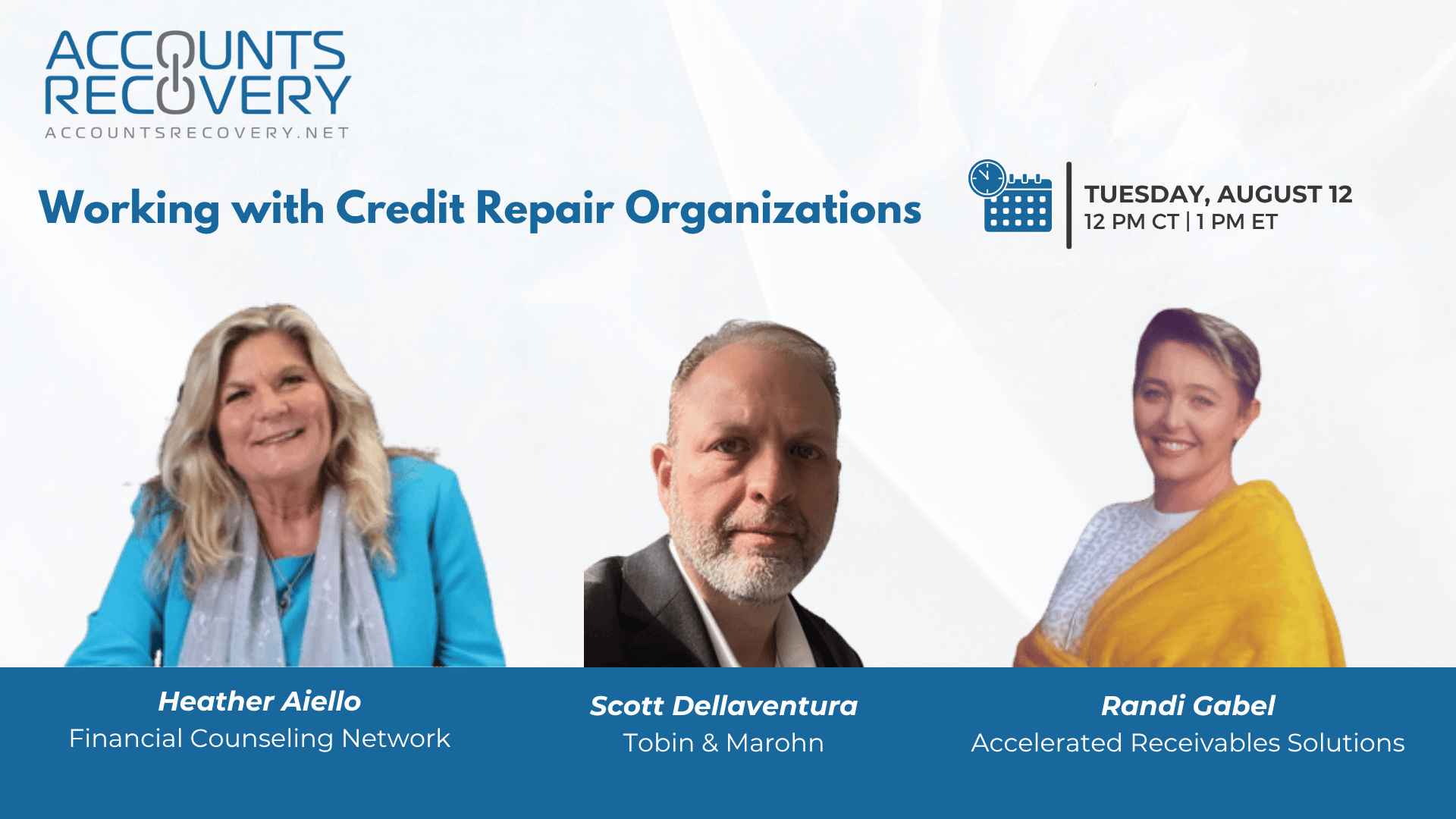

TODAY‘S WEBINAR

UPCOMING WEBINARS

Repeat Offender: Judge Rejects Another FDCPA Lawsuit from Serial Filer, Reinforces Permanent Injunction

A Magistrate judge in Ohio has once again dismissed a Fair Debt Collection Practices Act lawsuit filed by a frequent filer, reaffirming the need for prior court approval before the plaintiff can proceed with any future lawsuits. Judge J. Philip Calabrese of the District Court for the Northern District of Ohio went as far as to say that the claims were “so unsubstantial, frivolous and devoid of merit” that they did not warrant further proceedings.

CFPB Proposes Sharp Cutbacks to Oversight of Debt Collectors and Others

The Consumer Financial Protection Bureau is exploring changes that could dramatically reduce the number of nonbank companies subject to its supervision in the debt collection, credit reporting, auto finance, and international money transfer markets.

Mass. AG Secures $2M Settlement with Mortgage Servicer Over Foreclosure, Debt Collection Violations

A mortgage servicer has agreed to pay $2 million and overhaul its business practices to resolve allegations that it violated Massachusetts foreclosure prevention, debt collection, and consumer protection laws, according to an announcement from Attorney General Andrea Joy Campbell.

Capio Launches New Digital Engagement Portal to Empower Patients and Modernize the Medical Debt Repayment Experience

Capio, a leading purchaser of healthcare receivables, today announced the launch of its new digital engagement portal. Powered by BuoyFi’s proven technology, the portal provides a seamless and personalized experience that puts financial control back into the hands of patients.

WORTH NOTING: Saving money does more good than just in your wallet; it helps your mental well-being, too ... Capital One is moving all of its debit cards to Discover, meaning all of its customers are getting new cards ... Republicans loved referring upset consumers to the Consumer Financial Protection Bureau to complain, according to a published report ... Crime is at its lowest point in nearly 60 years ... Small business owners are going all-in on artificial intelligence, which is going to lead to more job opportunities ... No surprises here: teens aren't answering their phones anymore ... Prompts to help get you started with the new version of ChatGPT ... One man hit 389 jackpots in one day at a Florida casino.

Funny Friday, part I

Funny Friday, Part II

Webinar Recap: The Best Places to Look for New Clients Today

On our recent webinar, "The Best Places to Look for New Clients Today," industry experts Chris Kimes (Weltman Weinberg and Reese), Chris Repholz (CCS Companies), and Billy Rowlee (Finance System) shared valuable insights on sales strategies and market trends for credit and collection professionals. The panel, moderated by Mike Gibb of accountrecovery.net, emphasized that a one-size-fits-all approach is no longer effective and that success hinges on understanding your agency's strengths and the specific nuances of your target industries.

The discussion covered a range of topics, including identifying attractive markets, the challenges and opportunities in the medical debt space, and the best ways to approach networking and prospecting. The panelists agreed that building relationships, providing value, and being transparent with clients are critical for long-term success. They also advised against mass-prospecting tactics, instead advocating for a more "surgical" approach to finding the right clients who are a good fit for your agency's capabilities.

🧠 Key Takeaways:

Specialize, Don't Generalize: Instead of trying to be everything to everyone, identify the industries where your agency has proven expertise and focus on being great in those areas. Attempting to enter a new vertical without the proper internal knowledge and investment can lead to failure.

Know Your Audience: A prospecting strategy that works in the financial services sector may not be effective in healthcare. Research and understand the specific behaviors and norms of each market you target, from conference etiquette to communication preferences.

Prioritize Quality over Quantity in Prospecting: Move away from mass emails and cold calls. Instead, conduct "hard rock mining" to identify a small number of high-quality prospects. Offer them value through educational content or industry advisories and be patient with the sales cycle, which can take 18 months or longer.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN