- AccountsRecovery Daily Digest

- Posts

- Daily Digest - August 7, 2025

Daily Digest - August 7, 2025

Brought to you by: TCN | By Mike Gibb

🎂🎁 Happy Birthday to: Patrick Goodell of Coast Professional, Ankush Handa of Provana, and Melissa Raymond of National Debt Holdings.

🎉 Congratulations to Wendy Thomas for starting new position as Business Systems Analyst at National Recovery Associates, and Heather Holding as Chief Risk Officer at Best Egg.

August Meeting Schedule

Check out the upcoming meetings for August and note there are two new meetings — one to discuss collection platforms/software, and one for vendors to meet. Click on the link for each to register.

August 13 - Small Agency TechTactics

August 14 - Women in Collections

August 19 - Vendor Roundtable

August 19 - ARMTech Innovation Lab

August 21 - Compliance Chat

August 26 - Platform Pulse

Prevent a target from being put on your back. Attend Compliance-Con and learn from the experts.

Getting to Know Allison Latsch of Frost-Arnett Company

Let’s get the weird stuff out of the way first. Allison Latsch might be the first person in the history of the “Getting to Know” series who listed cleaning as her guilty pleasure. But when you read how she prepares for meetings and thought about pursuing a career in criminology and her honesty about reading, being fastidious just seems to be a core strength of hers. Read on to learn more about Allison, why work-life balance is important to her, and she likely throws a frisbee a lot better than you do.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

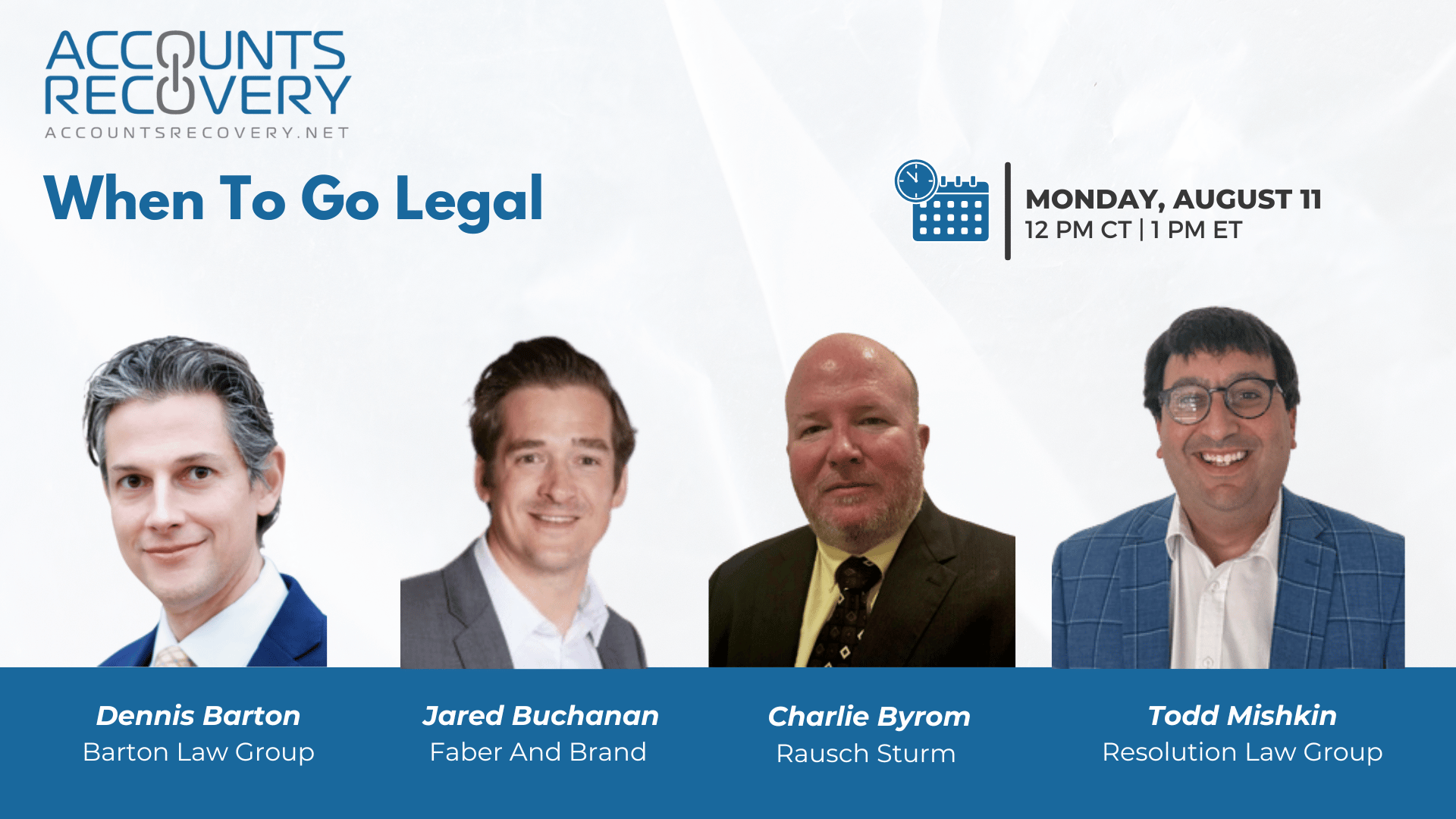

TODAY‘S WEBINAR

UPCOMING WEBINARS

Timing is Everything: Late Argument on Choice-of-Law Costs Collector in Fee Dispute

A Florida appeals court has reversed a lower court’s ruling and determined that a consumer is entitled to have his attorney fees covered by a collector that dismissed a collection lawsuit it filed, saying that the collector didn’t assert the choice-of-law provision from the underlying agreement soon enough in the proceedings.

FCC Removes 185 Providers From Robocall Database, Blocks Access to Telecom Networks

The Federal Communications Commission yesterday announced it had removed 185 voice service providers from its Robocall Mitigation Database. The move effectively cuts these providers off from the U.S. telephone network until they resolve their compliance issues.

Court Denies Motion to Arbitrate FDCPA Claims Over Time-Barred Lawsuit

A District Court judge in Maryland has denied a defendant’s motion to dismiss and a motion to compel arbitration in a Fair Debt Collection Practices Act class-action lawsuit, ruling the defendant waived its right to arbitration by filing a collection lawsuit first.

North American Recovery Announces Acquisition Debt$Net Collection Software

North American Recovery, a nationwide collection agency headquartered in West Valley City, Utah, today announced the acquisition of The Computer Manager, Inc., developers of Debt$Net Collection Software, located in Bremerton, Washington.

WORTH NOTING: AI chatbots are susceptible to repeating false medical information ... Sections of the Constitution are missing from the official government website ... There is a better way to teach your kids to ride a bike than using training wheels ... Some Buy Now, Pay Later lenders are not sharing data with the credit bureaus ... As an anxious person, I can absolutely relate to the things on this list ... The jobs that are most, and least, at risk of being replaced by AI ... How is The Big House number 11 on this list? ... Superman is now an ICE agent.

Top 10 Thursday, part I

Top 10 Thursday, Part II

Webinar Recap: How to Negotiate With Consumers

In a landscape increasingly shaped by data and automation, effective negotiation remains a human skill that can make or break account resolution. In this engaging and highly practical webinar, industry leaders Kelly Parsons-O’Brien, Kelli VanCleave, and Chris Duncan shared real-world strategies for negotiating with consumers—emphasizing empathy, flexibility, and behavioral insight.

The panelists challenged the outdated one-size-fits-all “payment tree” approach and instead advocated for listening-first strategies that adapt to each consumer’s unique financial situation. From understanding psychological triggers like embarrassment and justification, to using tools like spreadsheets for flexible payment modeling, this session offered collectors actionable guidance to improve results across phone and digital channels.

🧠 Key Takeaways:

Empathy Over Scripts: Replace rigid call scripts with conversations that uncover the “why” behind a consumer’s inability—or refusal—to pay. Asking probing questions like “How short are you on the balance?” builds trust and reveals negotiation opportunities.

Time vs. Amount: Negotiation isn't just about how much—it’s also about when. Offering weekly or biweekly options, tied to paydays or emotional milestones (like birthdays), helps consumers commit and stay on track.

Start Small, Build Momentum: A temporary payment plan, even a minimal one, increases long-term resolution chances. Two successful payments often lead to full account resolution.

This webinar reinforced a powerful truth: negotiation is part art, part science—and always about human connection.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN