- AccountsRecovery Daily Digest

- Posts

- Daily Digest - August 6, 2025

Daily Digest - August 6, 2025

Brought to you by: TCN | By Mike Gibb

🎂🎁 Happy Birthday to: Don Siler of Credence Global Solutions and Carl Harkleroad of Imagined.Cloud.

🎉 Congratulations to Megan Mandrell, who was promoted to President of Automated Business Solutions.

August Meeting Schedule

Check out the upcoming meetings for August and note there are two new meetings — one to discuss collection platforms/software, and one for vendors to meet. Click on the link for each to register.

August 13 - Small Agency TechTactics

August 14 - Women in Collections

August 19 - Vendor Roundtable

August 19 - ARMTech Innovation Lab

August 21 - Compliance Chat

August 26 - Platform Pulse

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

Court Weighs Whether Medical Recovery Company is a Debt Collector

I will say at the start that this is one of those “this appears interesting to me but I am not a lawyer and sometimes things I think are interesting turn out in fact to be not interesting at all” cases, but a District Court judge in Maryland has issued a ruling in a case that seems to involve a new type of company and whether it meets the state’s definition of debt collector.

A MESSAGE FROM TCN

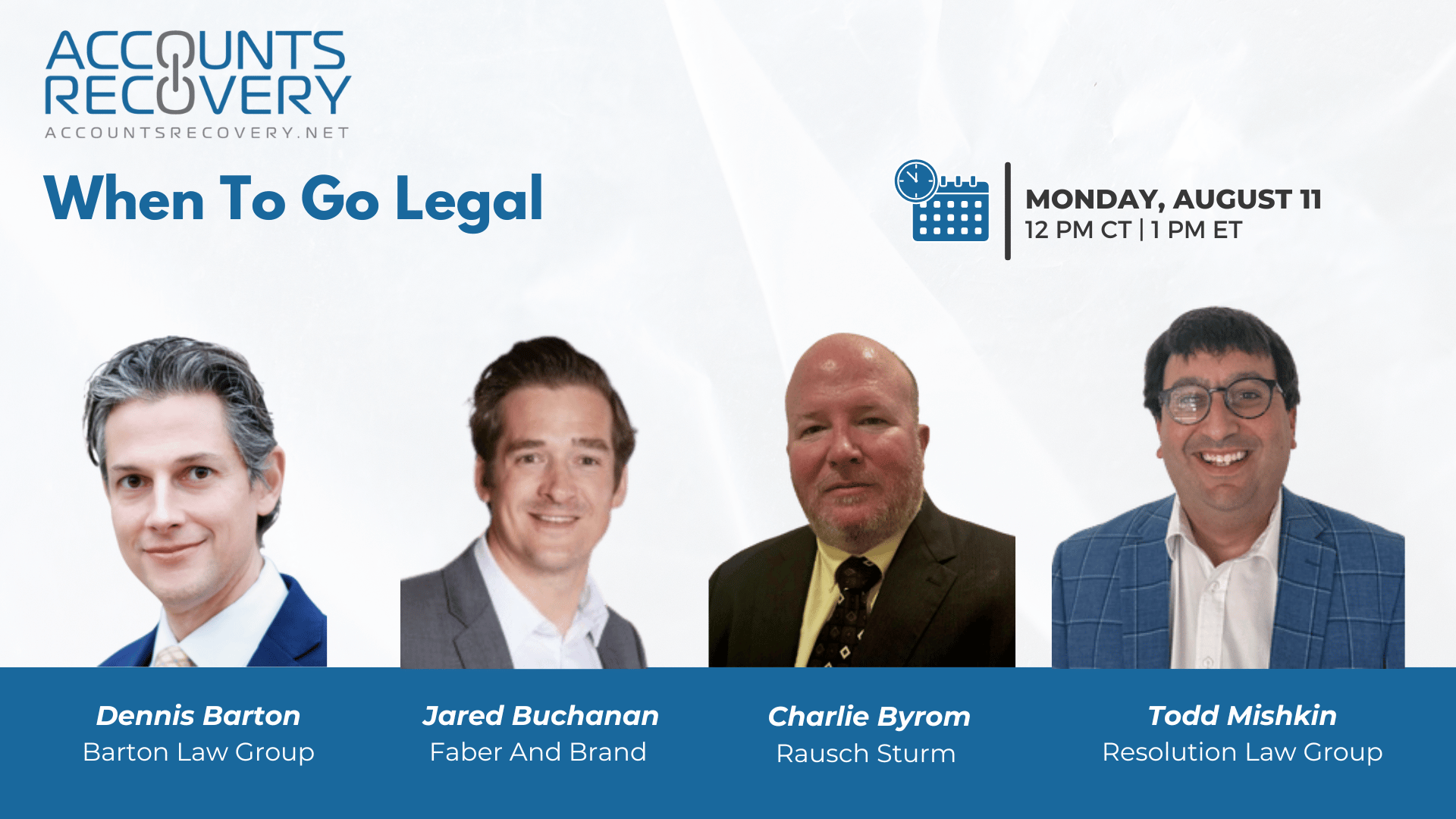

TODAY‘S WEBINAR

UPCOMING WEBINARS

Bipartisan Bill Targets Foreign Robocalls with New FCC-Led Task Force

Lawmakers on both sides of the aisle are turning up the heat on robocalls, especially those originating from overseas. Sen Ted Budd [R-N.C.] and Sen. Peter Welch [D-Vt.] have introduced S. 2666, the Foreign Robocall Elimination Act, a bill that would establish a new interagency task force to tackle unlawful foreign robocalls targeting Americans.

Unmonitored AI Is Driving Up Breach Costs, Especially in Healthcare

AI adoption in business is outpacing security and it’s costing companies dearly. IBM’s newly released 2025 Cost of a Data Breach report reveals that data breaches involving unmonitored or “shadow” AI are significantly more expensive, especially in sectors like healthcare, where personal information is a high-value target.

34 Companies Seeking Collection Talent

Nearly three dozen different companies from across the country are looking to fill jobs related to credit and collections. Your dream job might be on the list. Or maybe you know someone who would be a good fit and is looking. There are a million reasons to check out this week’s job listing summary.

Guest Column: CIOs are The New Margin Drivers in ARM and AI Agents are Their Team

In collections, technology used to live in the background. Now, it’s in the boardroom.Across lenders, agencies, and legal shops, CIOs are being asked one thing: “How will you use technology to improve margins?”

WORTH NOTING: A look at the household debt situation, which is holding stable ... A lot of colleges and universities are spending time chasing unpaid tuition ... An Indian debt collection platform has raised $7 million to develop a multi-lingual AI agent ... Would you have given your kid a tablet in this situation? ... Which town in the Northeast is the hottest housing market? ... The people who are falling behind on their student loans may surprise you ... How to fix your daily standup meetings so they don't fall flat ... Which college football teams have the toughest schedules this year? ... Very excited to have this show back in my life.

Wisdom Wednesday, part I

Wisdom Wednesday, Part II

Webinar Recap: Optimizing Email Campaigns for Maximum Consumer Engagement

In a panel discussion sponsored by CSS Impact, industry experts Josh Allen, Joe Gelbard, Frank Woodhouse, and Matt Jarrell explored how to elevate email as a collections communication channel. While email offers significant cost savings over letters and calls, it requires a distinct, consumer-focused approach to maximize engagement and drive payments.

The panel identified common mistakes, including writing exclusively for compliance rather than consumer action, adopting a one-size-fits-all message strategy, neglecting list hygiene, and over-focusing on subject lines without adequate testing. They emphasized that effective campaigns are built on understanding consumer behavior, segmenting audiences, and continuously refining content through A/B testing.

Key recommendations included:

Content Strategy: Differentiate between mandatory/legal notices and more casual follow-up emails, with the latter taking a personalized, approachable tone. Tailor messaging to behavioral “buckets” (e.g., forgetfulness vs. inability to pay) and adapt tone, timing, and intensity accordingly.

List Management: Maintain clean, segmented lists to improve deliverability and engagement. Suppress bad addresses promptly, leverage data hygiene tools, and monitor bounce and unsubscribe rates to protect domain reputation.

Calls to Action: Use direct, visible CTAs (“Make a Payment,” “Call Us Now”), minimize friction in the payment process, and offer multiple resolution channels to capture all payer types.

🧠 Key Takeaways:

Segment and Personalize – Avoid a generic approach; align content with consumer behaviors, payment likelihood, and debt type.

Prioritize Deliverability – Invest in list hygiene, domain reputation, and subject line best practices to avoid spam filters.

Measure What Matters – Track payer rates alongside engagement metrics to identify the content and strategies that directly drive payments.

By combining compliance with marketing best practices, agencies and creditors can turn email into one of their most powerful tools for consumer engagement and recovery.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN