- AccountsRecovery Daily Digest

- Posts

- Daily Digest - August 5, 2025

Daily Digest - August 5, 2025

Brought to you by: TCN | By Mike Gibb

🎂🎁 Happy Birthday to: Amanda Schenck of Lawgistic Partners, Linda Guinn of C B Merchant Services, and Erin Stewart of Symplicity Communications.

August Meeting Schedule

Check out the upcoming meetings for August and note there are two new meetings — one to discuss collection platforms/software, and one for vendors to meet. Click on the link for each to register.

August 13 - Small Agency TechTactics

August 14 - Women in Collections

August 19 - Vendor Roundtable

August 19 - ARMTech Innovation Lab

August 21 - Compliance Chat

August 26 - Platform Pulse

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

Suit From Serial Filer Accuses Collector of Violating TCPA

When you read enough complaints, you start to tell the ones that are written by professionals. An individual who has filed more than 75 lawsuits against different companies alleging they violated the Telephone Consumer Protection Act has accused a collection operation of violating the statute, accusing it of using an automated telephone dialing system to call him without his prior consent, and for not having a live representative speak to the plaintiff within two seconds after the greeting was completed, among other claims.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

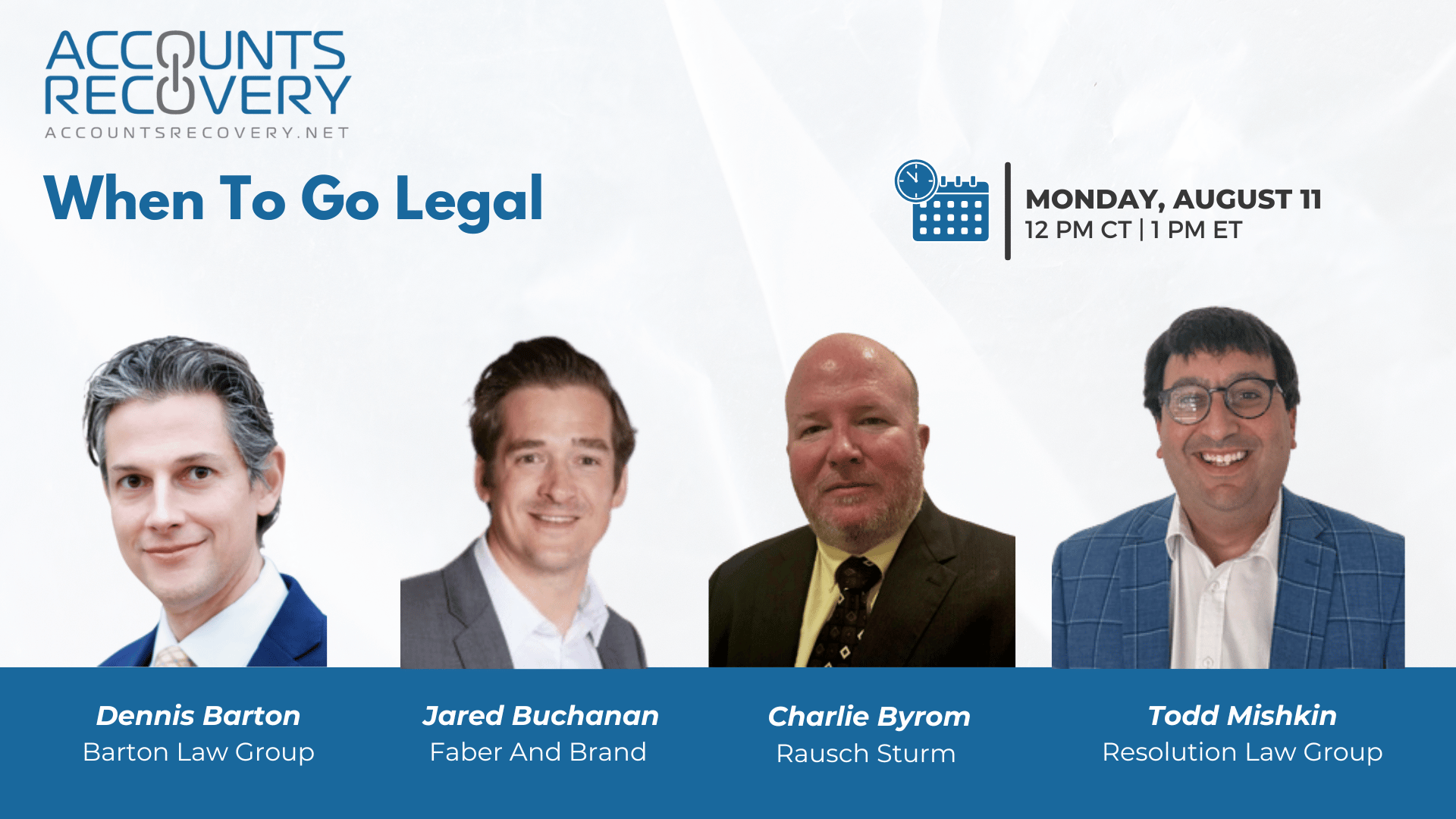

TODAY‘S WEBINAR

UPCOMING WEBINARS

CFPB Blasts GAO Over Funding Inquiry

The Consumer Financial Protection Bureau has come out swinging against the General Accounting Office, accusing of engaging in a “political” and “weaponized” campaign against the “historic” efforts of President Trump “to restore fiscal sanity and efficiency” to the federal government. CFPB Chief Legal Officer Mark Paoletta last week sent a scathing letter to the GAO, and to Congressional leaders, saying that the Bureau’s Acting Director was “well within his legal authorities” to decline additional funding from the Federal Reserve Board.

Judge Grants MSJ for Defendant in FDCPA Case Over Verification Letters Sent Post-Cease Request

A District Court judge in Louisiana has granted a defendant’s motion for summary judgment in a Fair Debt Collection Practices Act case over verification information that was sent to the plaintiff after the plaintiff submitted a cease request.

AI Sandboxes Could Soon Be Reality for Financial Services Firms

A bipartisan group of lawmakers have introduced H.R. 4801, the Unleashing AI Innovation in Financial Services Act, aiming to create AI Innovation Labs that allow financial firms to test artificial intelligence tools and products without fear of immediate regulatory enforcement.

WORTH NOTING: Housing markets that were hot during the pandemic have now cooled off ... How adjustable-rate mortgages are "bleeding" homeowners dry ... Nearly half of the children living in the United States live in households below middle class ... Did you know there are nine different "feelings of wealth"? ... What happens when you use ChatGPT as a couple's counselor ... Having a bat fly into your mouth is bad enough. Getting a bill for $20,000 made it worse ... More women are leaving the workforce ... Different artificial intelligence models can secretly transmit subliminal signals to one another.

Trailer Tuesday, part I

Trailer Tuesday, Part II

Webinar Recap: How to Train AI in your Operation

In the evolving credit and collections landscape, AI is no longer a futuristic concept—it’s an operational reality. This webinar, sponsored by Prodigal, brought together industry leaders to share strategies for effectively training and configuring AI tools to enhance collections, ensure compliance, and improve customer experience.

Speakers emphasized that today’s generative AI is fundamentally different from the “IVR-on-steroids” systems of the past. Modern AI agents can be fine-tuned to handle nuanced negotiations, follow agency-specific rules, and adapt to various debt types and consumer situations. The key is layering training: start with broadly capable models, then refine them with industry-specific and agency-specific guardrails to maintain compliance while preserving conversational flexibility.

Implementation doesn’t have to be a multi-year endeavor. Panelists shared that agencies can see value within weeks by targeting low-hanging fruit—like handling routine inquiries—before moving on to complex hardship negotiations. This approach not only delivers quick wins but also frees human agents to focus on high-value interactions.

Data governance was another critical point: agencies must ensure that training data is clean, segregated, and compliant with regulations, and that any AI vendor can clearly explain what their models were trained on. Proprietary strategies, such as rebuttals to common payment objections, should remain unique to each agency.

🧠 Key Takeaways:

Start Small, Scale Strategically – Begin with simple, repetitive tasks to gain quick ROI, then expand AI’s role to more complex scenarios.

Maintain Strong Data Governance – Use clean, compliant, and segregated data; ensure vendors disclose training sources and methods.

Layer Training for Precision – Combine general AI capabilities with industry-specific knowledge and agency-specific rules to achieve optimal performance without losing compliance or conversational quality.

AI in collections is here now—agencies that adopt a phased, well-governed approach can realize faster recoveries, lower costs, and improved customer satisfaction.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN