- AccountsRecovery Daily Digest

- Posts

- Daily Digest - August 18, 2025

Daily Digest - August 18, 2025

Brought to you by: TCN | By Mike Gibb

🎉🎂Happy Birthday to: Erika Sander of PEAC Solutions, Andy Pavlik of ACA International, Glenn Walters of PRA Group, and Tamara Girling of Roosen, Varchetti & Olivier. Happy belated Birthday to: Michelle Henderson Akindunni from CarMax (Aug. 17), John Dangoia of FIS (Aug. 17), Alicia Lesher of Central Portfolio Control (Aug. 17), Joy Jackson of Faber & Brand (Aug. 17) , Victoria Danielle of Guardian Litigation Group (Aug. 16), Michael Roncoroni of TransUnion (Aug. 16), Rich Schlegel of RevSpring (Aug. 16), and Dave Cherner of Clear Capital (Aug. 16).

🎉🎉Congratulations to: Jennifer Thompson for starting a new position as Director, Recovery Collections Vendor Management at Capital One, and Brian Patrick as Director of Projects and Analytics at Altum Healthcare Solutions.

There is a small retaining wall between my driveway and my front yard. It is mostly for show. It serves no real purpose. And it was tilting to one side. We had it replaced last month and having to pay for that felt like such a waste. We couldn't not have a wall there but it just felt like that money could have been spent in one of many more important, or fun ways.

The same is likely true for litigation budgets. Nobody wants to have to earmark funds to use if and when they get sued. Getting sued in and of itself is not an enjoyable experience. Putting money aside to deal with that feels like adding insult to injury. So make an investment that allows you to reduce your litigation budget. Register and come to ComplianceCon.

ComplianceCon will offer you the chance to learn from those on the frontlines. They are the ones interacting with regulators and consumer attorneys, the ones who defend these types of lawsuits all the time. They'll tell you what they are seeing, so you can take some steps that will likely lead to you getting sued less. And you get to enjoy some good hot chicken while you're doing it.

Check out the rock star list of speakers and topics at https://compliance-con.com.

Appeals Court: CFPB Can Proceed With Massive Layoffs

A federal appeals court has cleared the way for the Consumer Financial Protection Bureau to move forward with plans to lay off more than 1,400 employees; a move that could shrink the agency to roughly 200 staffers and, critics warn, cripple its ability to function.

A MESSAGE FROM TCN

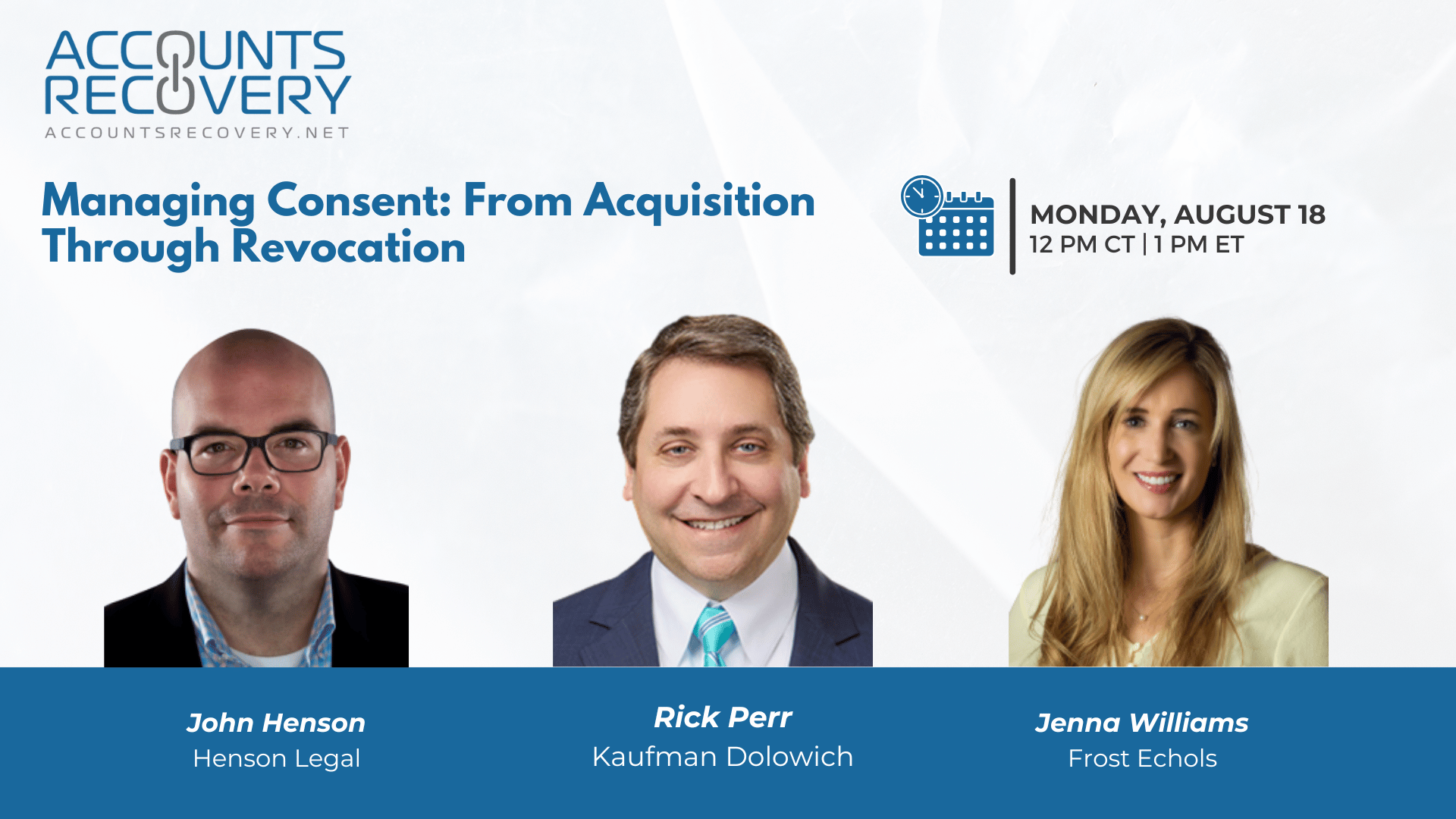

TODAY‘S WEBINAR

UPCOMING WEBINARS

Judge Approves FDCPA Settlement: Consumers Get $62 Each, Lawyers $66K

A District Court judge in New Jersey has signed off on a settlement in a class-action Fair Debt Collection Practices Act case that will see 52 class members split $3,250 while the plaintiff’s attorneys will earn more than $66,000 for their work.

Efficiency and Market Tailwinds Fuel Jefferson Capital’s First Post-IPO Results

Jefferson Capital, which went public in June, released its first quarterly earnings report as a public company last week. The company highlighted record collections, strong revenue growth, and an industry-leading efficiency ratio as it looks ahead to an active second half of the year.

Illinois Removes Repeal Date for Collection Agency Act, Strengthens Oversight

A new law has been enacted in Illinois that permanently extends the state’s Collection Agency Act, revises licensing rules for collection agencies and debt buyers, and strengthens oversight powers for regulators. Senate Bill 2457 amends the Collection Agency Act and removes its scheduled repeal date of Jan. 1, 2026, under the Regulatory Sunset Act. The measure also updates definitions, expands exemptions, clarifies out-of-state licensing rules, and enhances enforcement provisions for the Illinois Department of Financial and Professional Regulation (IDFPR).

Compliance Digest – August 18

What should you make of the CFPB's proposal to reduce the number of debt collection companies it will oversee? How should you interpret a ruling on whether a medical recovery company is a debt collector? How should you make changes after a ruling on sending information to a consumer who asked for communications to be ceased? Get answers to those questions and a lot more in this week's Compliance Digest, featuring insights from Justin Penn, Rick Perr, Stacy Rodriguez, Loraine Lyons, David Grassi, Mitch Williamson, and Jim Sandy.

This series is sponsored by Bedard Law Group

WORTH NOTING: What sets professionals apart in their daily tech habits ... What it's like to support a big family on a modest income in America today ... "Do it yourself" health insurance is becoming more popular with small businesses ... More Americans are becoming long-term renters ... The kitchen gear and utensils that firefighters swear by to help them cook for a crowd ... Ranking the TV shows and movies adapted from John Grisham books ... Friendship is getting too expensive, according to today's young adults ... How to clean your phone without damaging it.

Music Monday, part I

Music Monday, Part II

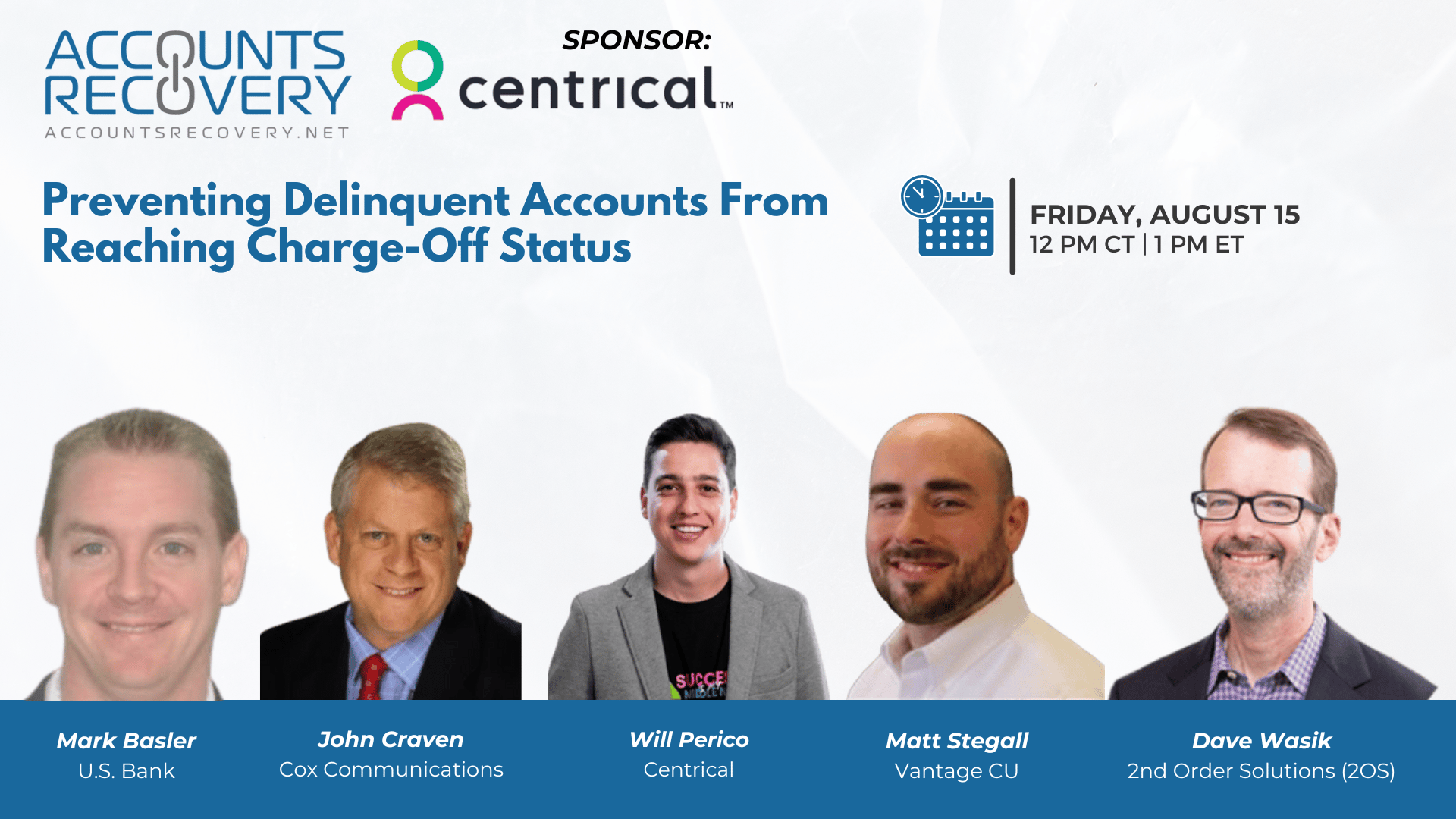

Webinar Recap: Preventing Delinquent Accounts From Reaching Charge-off Status

Charging off an account represents a loss for creditors and lasting financial consequences for consumers. In this webinar, sponsored by Centrico, panelists Dave Wasik (Second Order Solutions), Matt Stegall (Advantage Credit Union), and Will Perico (Centrico) shared strategies for preventing delinquent accounts from escalating to charge-offs.

The discussion emphasized the importance of spotting early warning indicators, tailoring outreach with empathy, and leveraging technology—especially AI-driven tools—to enhance collector effectiveness. Panelists highlighted how proactive communication, predictive scoring, and empowering collectors with actionable insights can significantly improve recovery rates while preserving long-term customer relationships.

Key themes included distinguishing between forgetful payers and those facing deeper financial hardship, offering flexible repayment or restructuring options, and using digital channels like SMS, push notifications, and online banking portals to meet consumers where they already engage. The speakers also stressed that maintaining consistent branding and celebrating customer milestones can build trust and encourage repayment. Finally, the conversation addressed collector motivation, noting that AI tools can ease administrative burdens, freeing agents to focus on meaningful customer interactions.

🧠 Key Takeaways:

Act on Early Indicators: Monitor changes in payment patterns, deposit flows, and consumer behavior. The faster collectors respond to signals, the greater the chance of preventing charge-off.

Use AI and Digital Tools Wisely: Predictive scoring, call sentiment analysis, and multi-channel outreach can guide collectors toward the right strategy, while automation reduces busywork.

Preserve Relationships with Empathy: Offer tailored solutions—such as payment extensions, restructures, or auto-pay options—while maintaining consistent branding and supportive messaging to strengthen long-term trust.

By combining data-driven insights with empathetic engagement, creditors and collectors can reduce losses, improve recovery, and protect valuable customer relationships.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN