- AccountsRecovery Daily Digest

- Posts

- Daily Digest - August 15, 2025

Daily Digest - August 15, 2025

Brought to you by: TCN | By Mike Gibb

New Training Bytes Video Published

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Ryan Thorpe from FFAM breaks down the differences between handling inbound and outbound calls. Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

Do you know what I hate about the list of things that keep me awake at night? It only gets longer. Things that kept me awake five years ago still keep me awake, only they are now joined by hundreds of new things that I've added. Now that I have had this realization, the growing list of things keeping me awake is going to keep me awake. Way to be self-aware, Mike! Woo hoo!

This is what makes events like ComplianceCon so important. Each of the sessions is a topic that is likely causing you some level of frustration or concern and, whether they realize it or not, the speakers provide reassurance and peace of mind to those who come looking for it. ComplianceCon has 44 confirmed panelists (with more being added every day), and each of them are experts, not just in the field of credit and collection compliance, but in curing sleep disorders.

Check out the rock star list of speakers and topics at https://compliance-con.com.

Collector Accused of TCPA, FDCPA Violations for Calls, Voicemails After Cease Request was Made

A collection operation is facing claims it violated the Fair Debt Collection Practices Act and the Telephone Consumer Protection Act by placing calls and leaving prerecorded voicemail messages on a consumer’s cell phone after she requested the defendant stop making collection calls.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

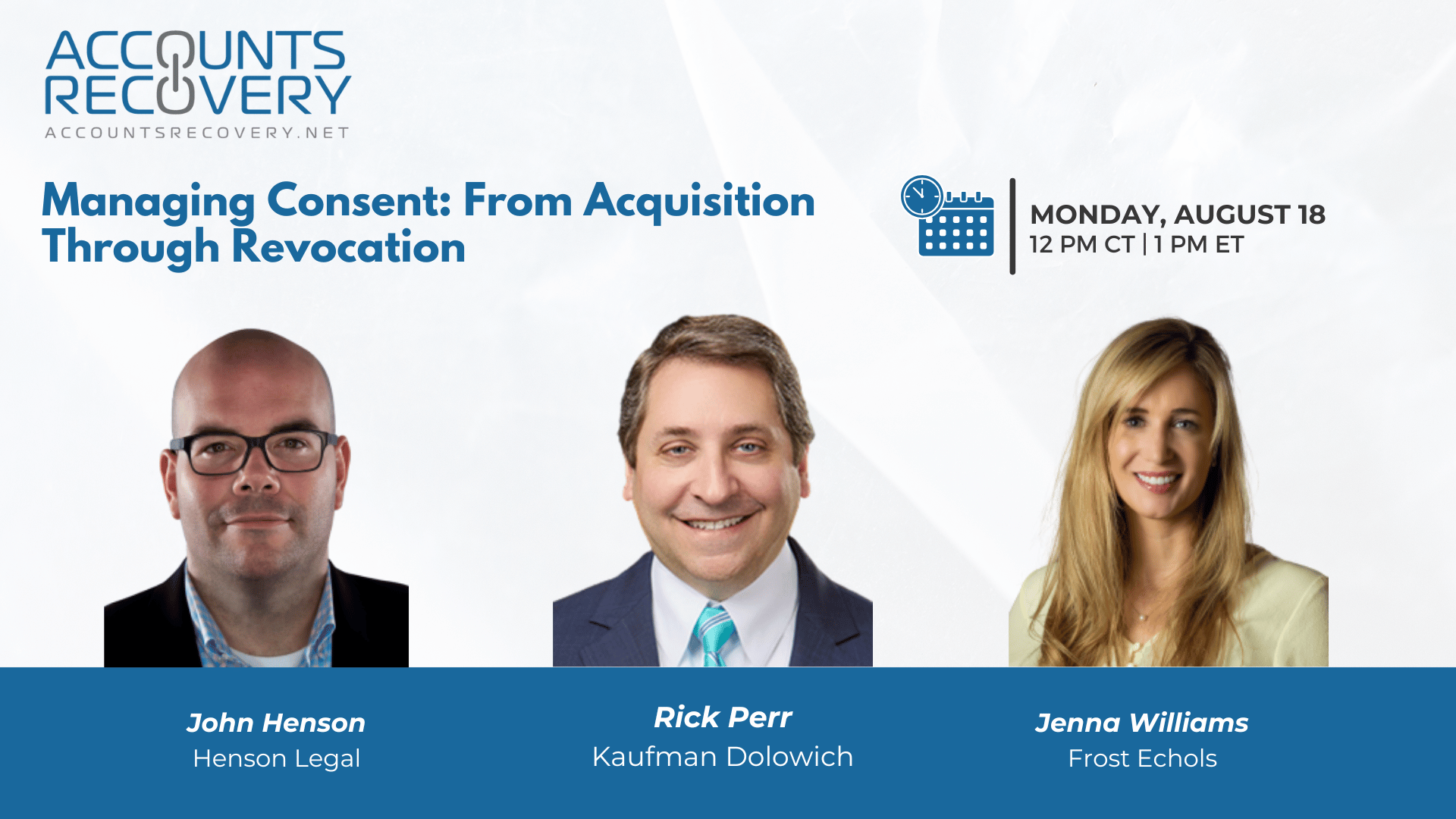

TODAY‘S WEBINAR

UPCOMING WEBINARS

Court: Saying ‘It’s Never Convenient’ Isn’t Enough for an FDCPA Claim

A District Court judge in New Jersey has granted a defendant’s motion to dismiss a Fair Debt Collection Practices Act suit that was filed essentially because the plaintiff objected to being contacted at all about the underlying debt.

One Click, $2 Million: NY DFS Penalizes Company Over Phishing Breach

One customer service employee who clicked on one email has led to an enforcement action that will cost a company $2 million to settle with the New York Department of Financial Services, the regulator announced yesterday.

AI’s Next Frontier: Why Responsible AI is Becoming Business-Critical

A new report from the Infosys Knowledge Institute warns that companies are embracing AI faster than they’re building the safeguards to deploy it responsibly, a gap that could have serious financial and reputational consequences, especially as “agentic AI” systems, which act autonomously, become more common.

WORTH NOTING: A debate about whether student loans help or hurt your future financial prospects ... A lot of Americans are stuck and feel paralyzed, unable to find new jobs or new places to live ... A look at how college students feel about their future economic prospects ... When it comes to steps, 7,000 is the new 10,000 ... People who live to 100 years old have some things in common, according to science ... The CEO of Starbucks wants you to have your drink within four minutes of placing your order ... After more than 30 years of keeping prices constant, the cost of AriZona iced team may be on the rise ... YouTube is going to start using AI to guess your age, as a means of limiting questionable content for young viewers.

Funny Friday, part I

Funny Friday, Part II

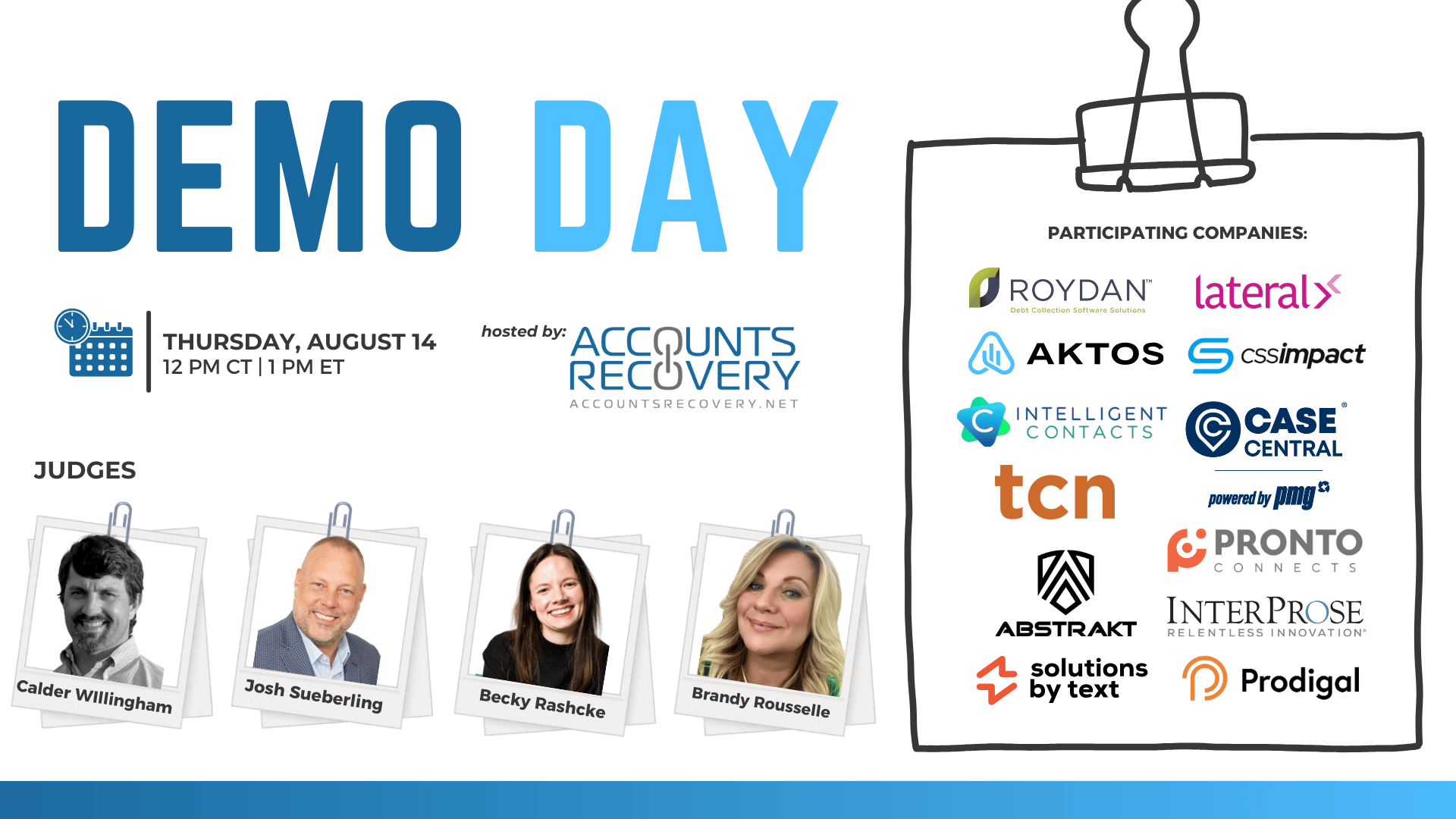

Webinar Recap: Demo Day

The latest Demo Day showcased innovative tools and technologies designed to improve efficiency, compliance, and consumer engagement across the credit and collections industry. Twelve vendors demonstrated solutions ranging from AI-powered call assistants to multi-channel communication platforms and advanced compliance engines.

Key innovations included:

AI-driven agent assistance and voice bots capable of handling inbound/outbound calls, negotiating payment plans, spotting keywords, and even automating payment setup.

Omnichannel messaging solutions integrating SMS, MMS, RCS, email, and chat into a single agent interface—many with real-time automation and TCPA-friendly options.

Payment tools that embed Apple Pay/Google Pay into text-based payment requests to speed up transactions and reduce abandonment.

Compliance-focused platforms streamlining dispute resolution, adding QA layers, automating safe resolutions, and generating audit-ready documentation.

Configurable, vendor-agnostic systems of record that integrate with multiple AI and communication providers, paired with built-in compliance engines.

🧠 Key Takeaways:

AI Is Moving Beyond Novelty

Multiple vendors demonstrated AI that actively drives collections—guiding agents in real time, managing compliance steps, or speaking directly to consumers. Evaluate where AI can eliminate manual steps without sacrificing accuracy or compliance.Frictionless Payments Increase Recovery Rates

Offering secure, instant payment options directly within text conversations—especially with eWallets—can triple follow-through rates. Agencies should consider reducing portal logins and multi-step authentication where compliance allows.Omnichannel Communication Is Now the Standard

Consumers expect to interact through their preferred channel—text, email, chat, or voice—without repeating themselves. Platforms that unify these interactions in real time can boost engagement, response speed, and customer satisfaction.

These demos underscore a clear industry trend: agencies that adopt integrated, compliant automation and meet consumers on their preferred channels are positioned to improve both efficiency and liquidation rates.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN