- AccountsRecovery Daily Digest

- Posts

- Daily Digest - August 14, 2025

Daily Digest - August 14, 2025

Brought to you by: TCN | By Mike Gibb

🎂🎁 Happy Birthday to: Kate McCoy of Performant Healthcare, Kristin Cooper of Gulf Coast, Matt Kiefer of MKiefer Consulting, and Cliff Sanders of CannaBIZ Collects.

August Meeting Schedule

Check out the upcoming meetings for August and note there are two new meetings — one to discuss collection platforms/software, and one for vendors to meet. Click on the link for each to register.

🚨 TODAY at 3pm ET - Women in Collections 🚨

August 19 - Vendor Roundtable

August 19 - ARMTech Innovation Lab

August 21 - Compliance Chat

August 26 - Platform Pulse

Nobody will disagree that there are plenty of opportunities for companies in the credit and collection space to engage with consumers today. Whether you choose to take advantage of those opportunities depends entirely on whether you want to stick your head out a little bit and take some risk. The primary reason why companies refuse to engage with consumers in channels other than letters and phone calls is because they are afraid of the risk. But they don't have to be afraid. There is a path you can follow. Others have done it and can show you the way.

ComplianceCon offers you the unique opportunity to engage with peers and colleagues from across the industry -- banks, credit unions, debt buyers, healthcare providers, fintechs, collection agencies, and more. The experts that everyone listens to for advice are going to be there. See how they are doing it and take those lessons back to your own operation. Don't let opportunity pass you by. https://compliance-con.com

Getting to Know Sthevens Rodriguez of Debt Dynamics Solutions

It’s great to see someone fresh coming into the industry and trying to make a go of it, especially someone with as much hustle as Sthevens Rodriguez. Working full-time while building a collection operation can’t be easy, but this former at-home baker is hoping to make Debt Dynamics Solutions rise, too. Read on to learn more about Sthevens, what it takes to get him going in the morning, and why he loves networking.

This series is sponsored by TEC Services Group

A MESSAGE FROM TCN

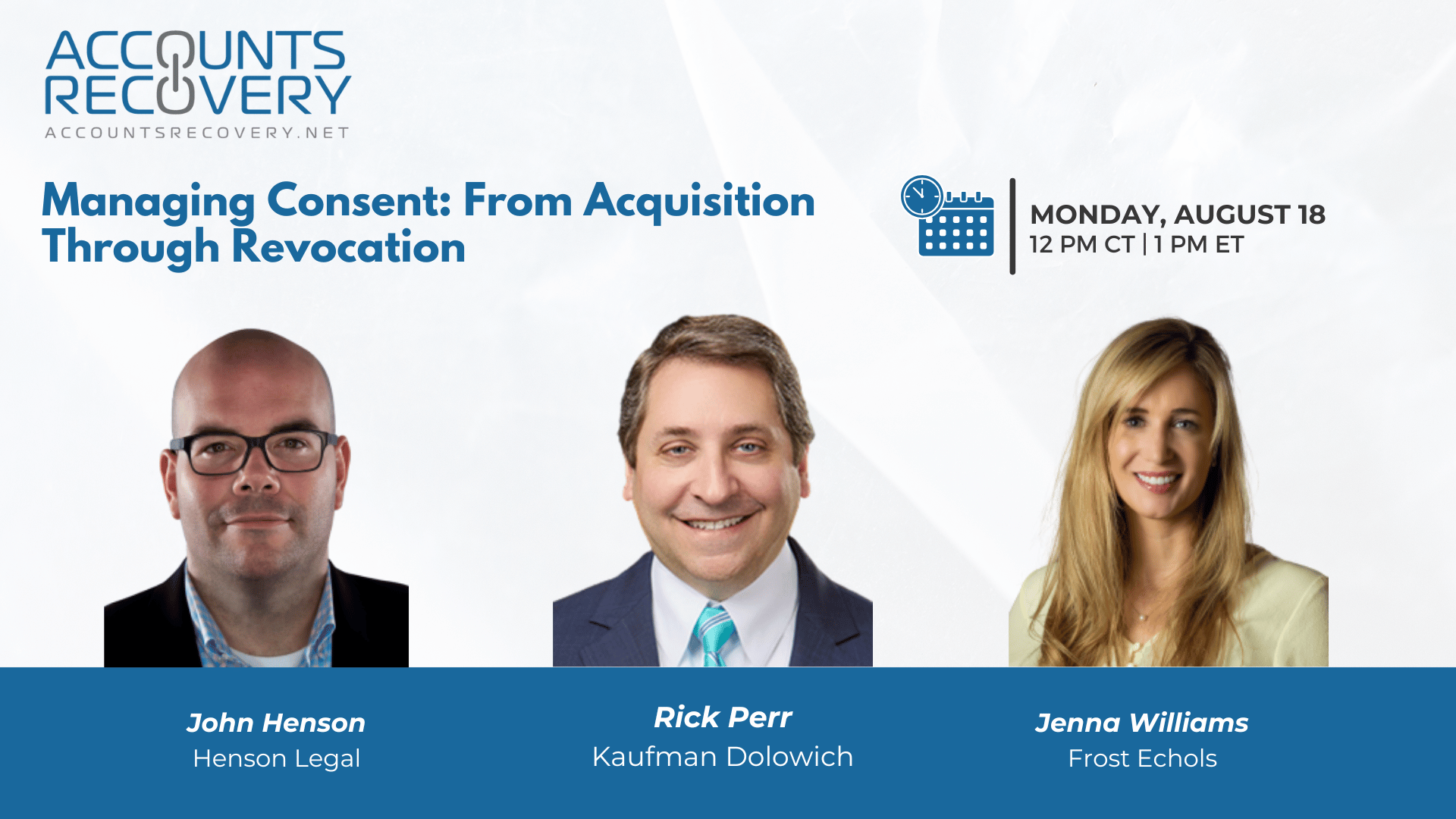

TODAY‘S WEBINAR

UPCOMING WEBINARS

Appeals Court: One Unwanted Letter After Cease Request Not Enough for Standing

The Court of Appeals for the Eighth Circuit has reversed a lower court’s summary judgment ruling in favor of a plaintiff where the defendant was ordered to pay $60,000 in attorney’s fees, ruling that receiving a letter after a cease request was sent is not enough for the plaintiff to have standing to pursue her Fair Debt Collection Practices Act lawsuit.

Household Debt Growth Steady, but Student Loan Delinquencies Surge — Especially for Older Borrowers

The Federal Reserve Bank of New York’s second quarter Household Debt and Credit Report shows steady overall debt growth but a troubling spike in student loan delinquencies, especially among older borrowers.

NY AG Picks Up Zelle Lawsuit After CFPB Drops It

The Attorney General of New York is picking up where the Consumer Financial Protection Bureau left off, filing a lawsuit yesterday against the owner of the Zelle payment platform, alleging it knew its platform was susceptible to fraudsters who bilked consumers out of more than $1 billion.

WORTH NOTING: The states where being a homeowner pays off the most, and the least ... A majority of consumers are still choosing to pay their bills manually every month ... Google is looking to expand its payment services ... A lot of parents are going into debt to provide for their children ... The views from the International Space Station are out of this world ... The percentage of Americans who say they drink alcohol has hit a new all-time low ... A viral treadmill trend that may help you burn more fat even if it burns fewer calories ... How to get 25-cent wine at Olive Garden restaurants.

Top 5 Thursday, part I

Top 5 Thursday, Part II

Webinar Recap: Assessing the Risk/Reward of Different AI Solutions

As artificial intelligence rapidly transforms the credit and collections industry, knowing how to assess the risks and rewards of AI tools has never been more critical. In a recent webinar sponsored by CSS Impact, experts Kyle Huff, Lauren Valenzuela, and Scott E. Wortman provided a practical framework for evaluating AI solutions—ensuring innovation aligns with compliance, data security, and business goals.

The panel stressed that AI adoption should be driven by a clear business purpose, not by chasing trends or “collecting tech toys.” Evaluators must understand what problem the AI solves, whether it replaces or augments existing capabilities, and what data it will process—especially when handling regulated information like PII or financial records. The group also highlighted the growing need for AI governance programs to combat “shadow AI” use, where employees deploy unapproved tools without oversight.

Compliance and security were recurring themes. Panelists advised against uploading sensitive data to open systems, recommended vendor due diligence, and urged regular reviews of AI tools even after deployment. They warned about AI-specific threats such as prompt injection, biased outputs, and unauthorized data training, emphasizing the importance of human validation for all outputs.

🧠 Key Takeaways:

Establish Clear Use Cases & Governance – Define the business problem, ensure AI adoption aligns with core principles, and implement governance to control usage and prevent shadow AI.

Prioritize Data Security & Compliance – Use closed, secure environments for sensitive data; vet vendors thoroughly; and maintain oversight through regular reviews.

Start Small & Scale Responsibly – Begin with low-risk, internal applications, validate outputs with human review, and expand only as the organization builds AI fluency and trust.

In an era where every product claims to have AI, disciplined evaluation and governance will determine whether AI delivers measurable value—or exposes your organization to unnecessary risk.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN