- AccountsRecovery Daily Digest

- Posts

- Daily Digest - August 12, 2025

Daily Digest - August 12, 2025

Brought to you by: TCN | By Mike Gibb

🎂🎁 Happy Birthday to: Ryan Henry of MRS BPO, Eil Smith of Anchor Pay, and Jenny deHoyos of Capio.

🎉 Congratulations to DeJuan Renfroe for starting a new position as Sr. Audit & Regulatory Manager at Dyck-O'Neal, Beth Krebs as AVP Digital Product Marketing at PRA Group, Brian Knapp as Senior Business Development Specialist at Verint, and John Edgley, ETA CPP as Director, Strategic Account Management - Banking and Platform Services at Priority.

August Meeting Schedule

Check out the upcoming meetings for August and note there are two new meetings — one to discuss collection platforms/software, and one for vendors to meet. Click on the link for each to register.

August 13 - Small Agency TechTactics

August 14 - Women in Collections

August 19 - Vendor Roundtable

August 19 - ARMTech Innovation Lab

August 21 - Compliance Chat

August 26 - Platform Pulse

State AGs and regulators may not always launch full-scale investigations at the jump. In many cases, they make informal inquiries that ask a question or two. Based on your answers, they may then choose to launch an investigation or conduct an examination. Knowing how to respond to these types of inquiries can make all the difference in what happens next.

Come to ComplianceCon and learn how to handle inquiries from state regulators, especially as they are expecting to pick up the torch from the Consumer Financial Protection Bureau. Sign up today!

FDCPA Suit Says Debt Should Have Been Extinguished Under CFPB Enforcement Action

This is a tree-in-the-forest scenario … If a debt is not owed, can it be time-barred at the same time? A collection operation and a debt buyer are facing a class-action lawsuit in Kentucky federal court for allegedly violating the Fair Debt Collection Practices Act because they attempted to collect on a debt that was time-barred and attempted to collect on a debt that was not owed — the same debt for both claims.

This series is sponsored by WebRecon

A MESSAGE FROM TCN

TODAY‘S WEBINAR

UPCOMING WEBINARS

Arbitration Clause Survives State Court Judgment in Kentucky FDCPA Dispute

We’ve seen some cases go the other way recently, so it feels like this needs to be noted … A District Court judge in Kentucky has granted a defendant’s motion to compel arbitration in a Fair Debt Collection Practices Act class-action lawsuit, disagreeing with the plaintiff that filing a lawsuit to collect on the unpaid debt waived the underlying agreement’s arbitration provision.

One-Time e-OSCAR Issue Prevents ACDV Responses From Being Transmitted

The company that manages e-OSCAR last week sent out an email, urging data furnishers to review their records and address potential inaccuracies in their credit reporting.

Wisconsin Bill Would Bar Collections on Debts from Hospitals That Violate Price Transparency Rules

A new bill has been introduced in the Wisconsin Senate which would impose strict hospital price transparency requirements and block certain debt collection actions against patients if the hospital fails to comply.

WORTH NOTING: Doctors are working more than ever, but the only things that are increasing are the amounts of uncompensated debt and bad debt ... How AI can make paying bills easier ... More consumers are worried about their finances and are doing things like turning to thrifting ... Are bright lights bad for your eyes? ... A $13 million dollar mansion where the price is dropping $250,000 every week until someone buys it ... The surest way to future-proof your career ... The right way to quit your job ... You may want to think twice before booking that next Spirit Airlines flight.

Trailer Tuesday, part I

Trailer Tuesday, Part II

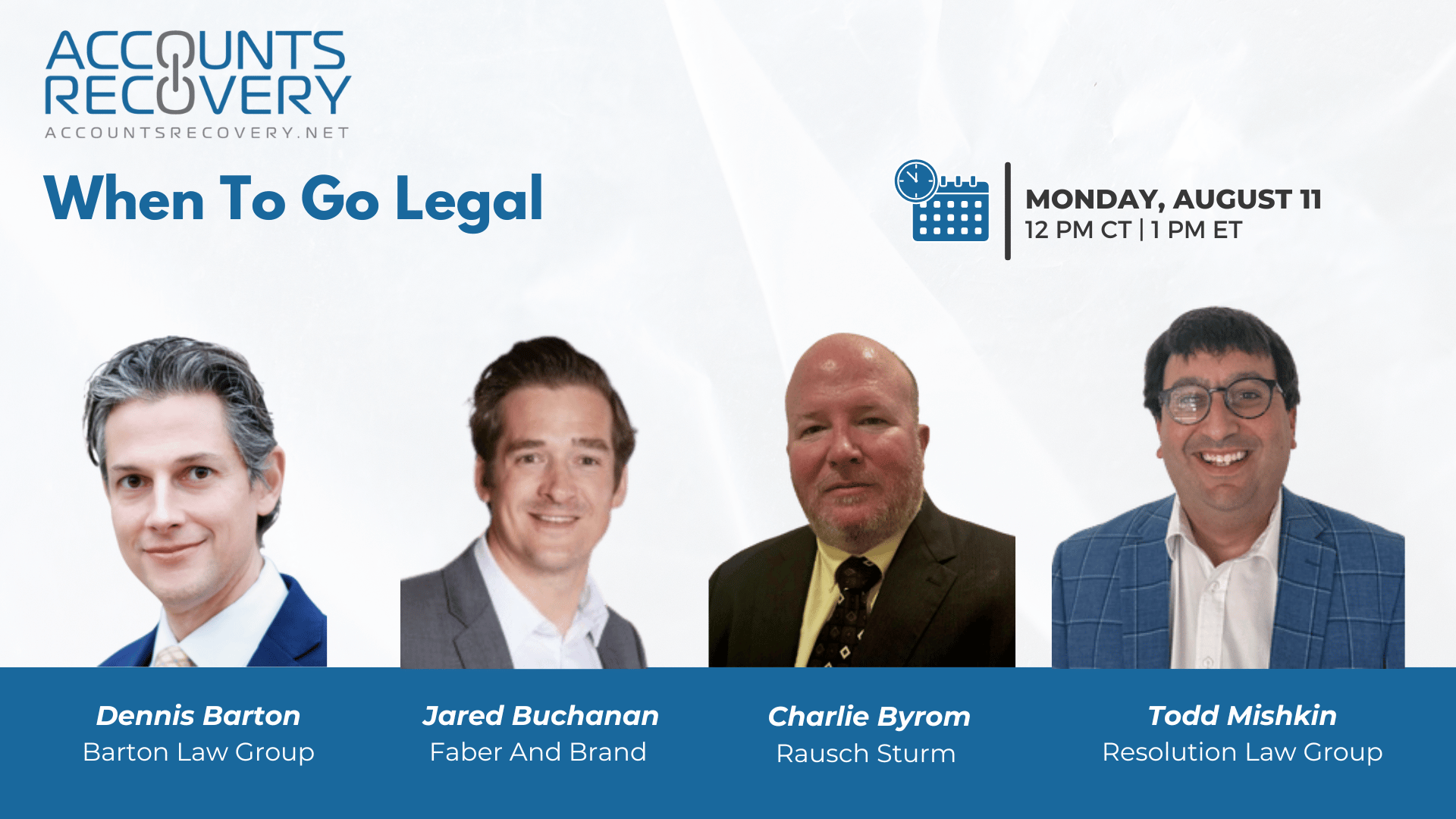

Webinar Recap: When to go Legal

Making the decision to pursue legal collections is part art, part science—and the wrong choice can waste time, money, and reputation. In this webinar, a panel of seasoned legal collections experts shared insights on evaluating when litigation is the right move, balancing recoverability with cost, and preparing your operation to succeed in court.

Key Points:

Assess the Financials First – Before filing, calculate the “amount in controversy” factoring in principal, interest, attorney’s fees, and court costs, which can vary widely by state and venue. Even a small balance might be worth pursuing in certain jurisdictions if interest rates and fee recovery are favorable.

Know Your Collection Environment – Venue selection, statute of limitations, and timeline to judgment can dramatically influence success. Understanding debtor assets—especially stable employment—is critical, as full-time employment is often the best predictor of recovery.

Partner, Prepare, and Protect Reputation – Choosing the right law firm and vendors ensures compliance, mitigates reputational risk, and enables effective settlements. Communication with counsel about settlement authority and expectations should be set early to avoid delays.

🧠 Key Takeaways:

Develop a Clear Litigation Criteria Checklist – Include debt amount thresholds by state, asset verification, statute deadlines, and service address accuracy before approving legal action.

Invest in Pre-Legal Data Collection – Train staff and educate creditor clients to gather employment, banking, and other asset data early. This upstream information can be decisive if the account moves to legal.

Build Legal-Ready Infrastructure – Have documentation, affidavits, and processes in place before filing. Without them, even strong cases can fail.

The panel agreed: once you decide to go legal, be ready to move efficiently, seize settlement opportunities—especially face-to-face in court—and treat consumers with professionalism to protect long-term relationships.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN