- AccountsRecovery Daily Digest

- Posts

- Daily Digest - August 11, 2025

Daily Digest - August 11, 2025

Brought to you by: TCN | By Mike Gibb

🎂🎁 Happy Birthday to: Sean Ebeling of Cascade365, Sharon Mancero of Agora Data, and Gayla Huber of IntegriShield. Happy belated Birthday to: Richard Rotondo of Digital Vision Banking (Aug. 10), and Shannon Hansen of CCMR3 (Aug. 10).

🎉 Congratulations to Jessica James for starting a new position of Director of Legal Operations at Rausch Sturm, Charles Dunn as Debt Negotiator at Synergy Debt Relief, Heather Gilb as VP of the Indiana Collectors Association, and Alyssa Riley as Director of Lien Management at Community Choice Financial.

August Meeting Schedule

Check out the upcoming meetings for August and note there are two new meetings — one to discuss collection platforms/software, and one for vendors to meet. Click on the link for each to register.

August 13 - Small Agency TechTactics

August 14 - Women in Collections

August 19 - Vendor Roundtable

August 19 - ARMTech Innovation Lab

August 21 - Compliance Chat

August 26 - Platform Pulse

Prevent a target from being put on your back. Attend Compliance-Con and learn from the experts.

Judge Dismisses FDCPA Suit Against Credit Union

There are rulings that you read because they are informative and there are rulings that you read because they are entertaining. We have a plaintiff who is referred to by the judge as a sovereign citizen and the phrase “wet-ink signature” is mentioned. Guess which one this is? A District Court judge in Wisconsin has granted a credit union’s motion to dismiss a Fair Debt Collection Practices Act for all the reasons you might expect a judge to do so when dealing with this type of situation.

A MESSAGE FROM TCN

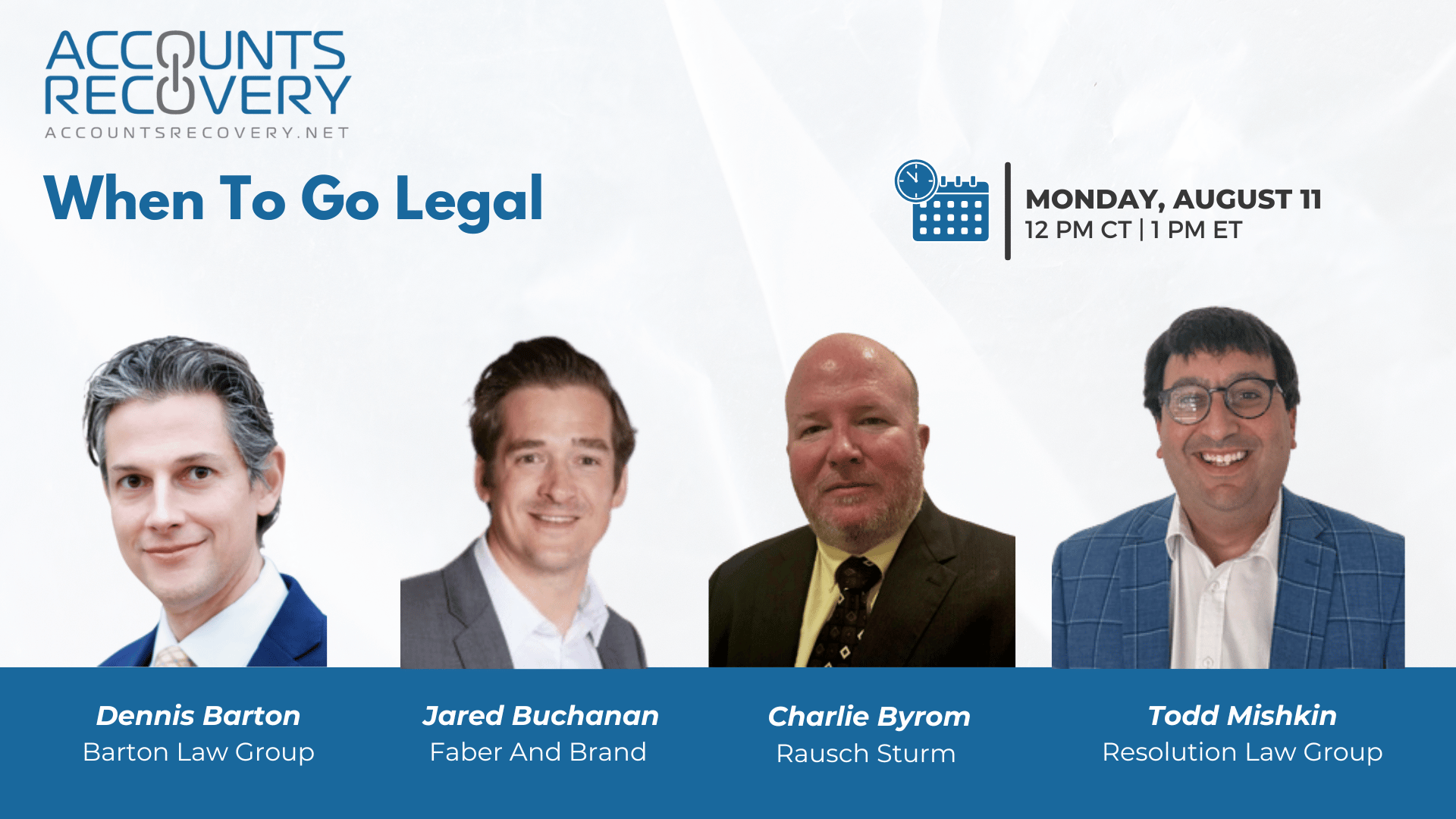

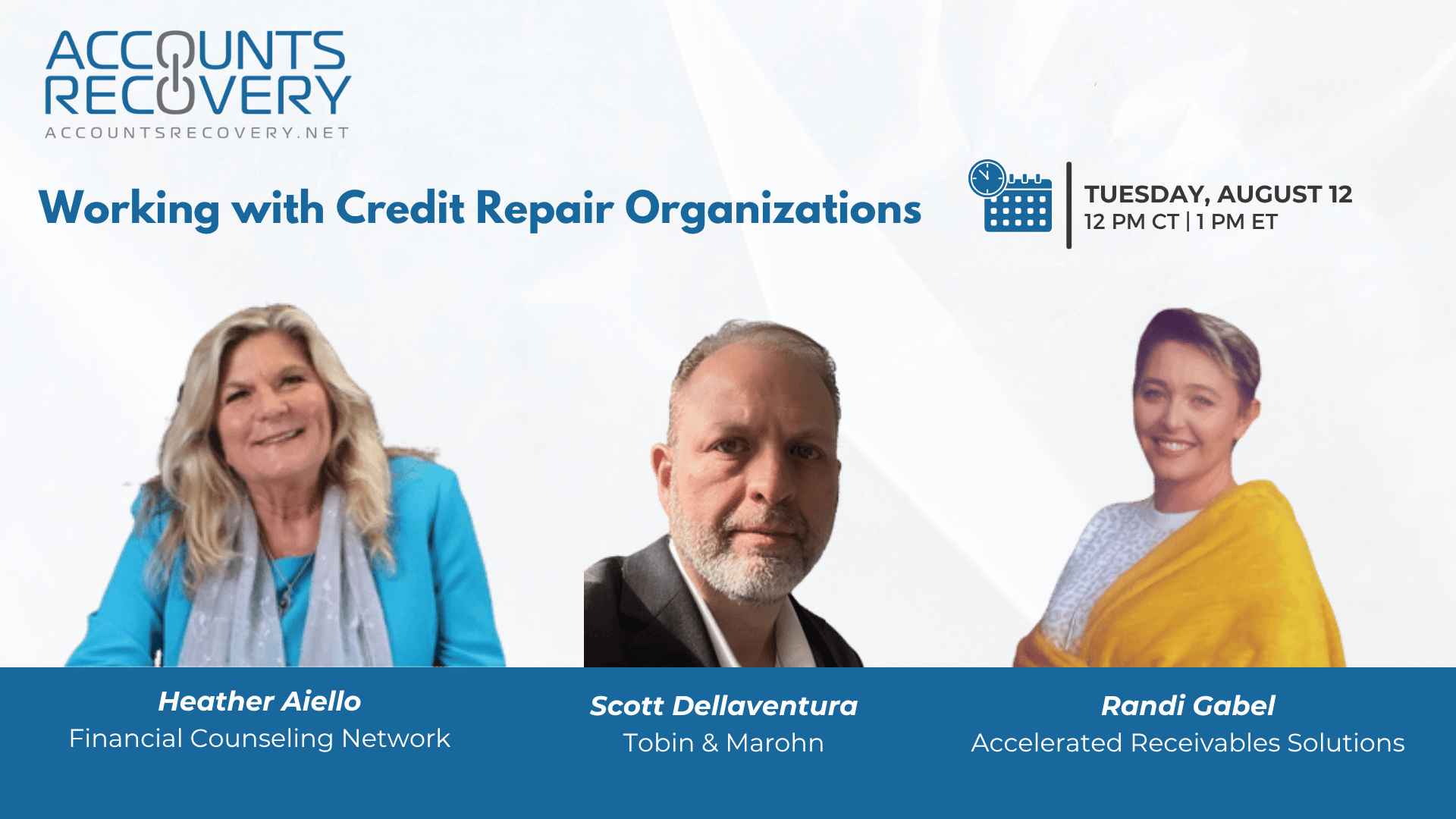

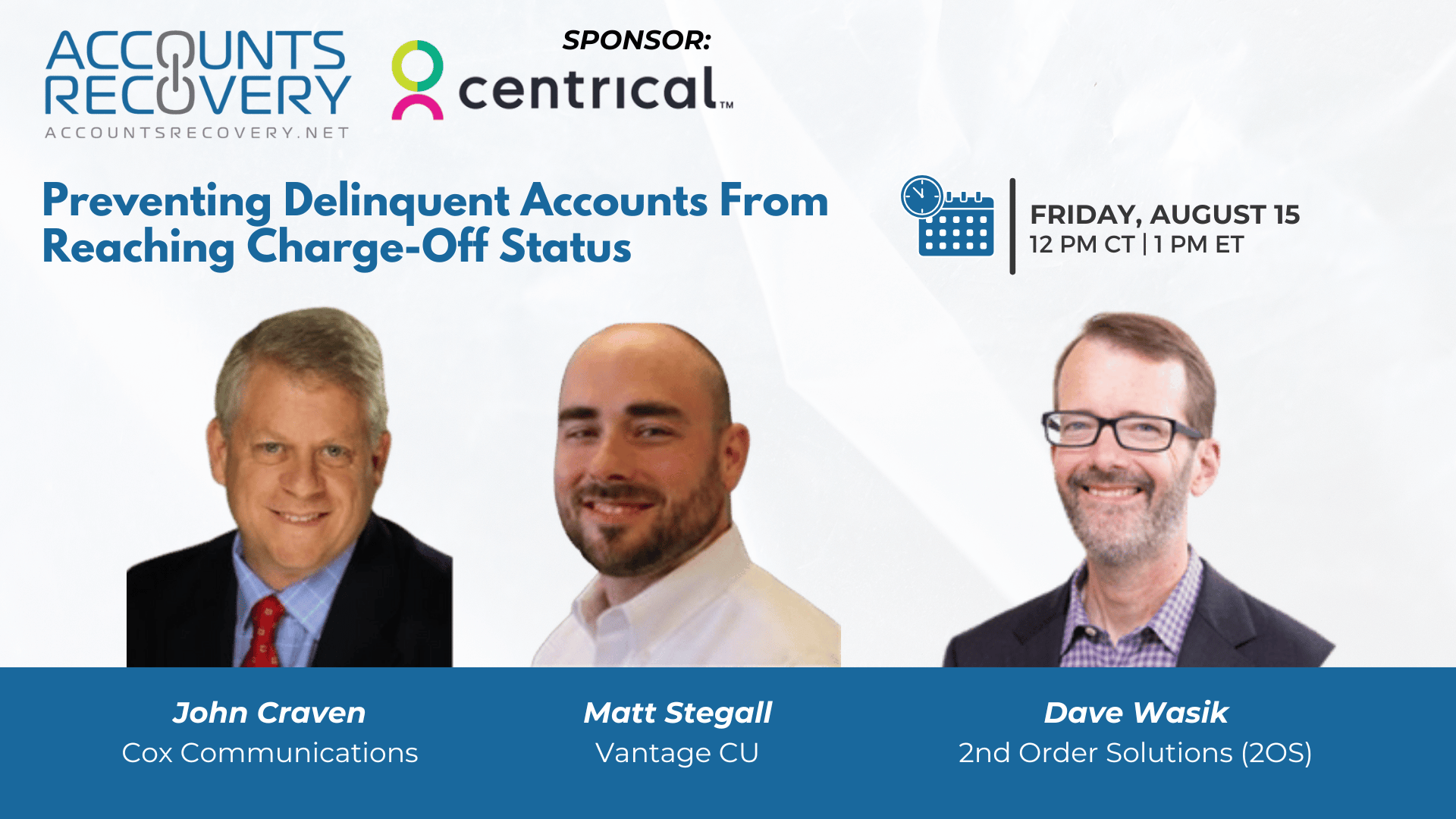

TODAY‘S WEBINAR

UPCOMING WEBINARS

Appeals Court Upholds $243M Judgment Against Student Loan Debt Relief Scammer

The Court of Appeals for the Ninth Circuit Court has affirmed a lower court’s ruling against a student loan debt relief company and its owner for operating a fraudulent student loan debt relief scheme. The lawsuit, originally filed in 2019 by the Consumer Financial Protection Bureau, the Attorney General of Minnesota, and the states of North Carolina and California, alleged that Wen and his companies illegally charged borrowers up to $1,899 in advance fees for services tied to federal loan repayment and consolidation programs.

51 State AGs Target 37 Providers in Nationwide Robocall Crackdown

A bipartisan coalition of 51 state attorneys general have launched Operation Robocall Roundup, a multistate enforcement effort aimed at shutting down illegal robocalls. Thirty-seven voice providers last week received formal warning letters directing them to comply with federal law or face enforcement.

Compliance Digest – August 11

Rulings from federal and state courts of appeal; new bills in Congress and new rules from the CFPB; and rulings on standing and the bona fide error defense. Chances are, regardless of where you work or what you do, something there applies to you. So check out the Compliance Digest and get the perspective and insight you need to make decisions that make you look like you know what you are doing.

This series is sponsored by Bedard Law Group

WORTH NOTING: Are you one of the many people who skip eating a full lunch every day because you are too busy at work? ... The postal service in Denmark is going to stop delivering letters by the end of this year ... When someone says "make yourself at home," good houseguests don't ... Not everyone is happy with the remodeling that is being done at Cracker Barrel restaurants ... A personal finance influencer is warning consumers to stay away from Buy Now, Pay Later loans ... More than 60% of Generation Z have no emergency savings, according to a survey from Credit One Bank ... A list of 21 different ways that people are using AI at work ... Why your company is failing at creating the next generation of leaders.

Music Monday, part I

Music Monday, Part II

Webinar Recap: Preparing for State Investigations and Examinations

With CFPB oversight scaling back, state regulators are stepping up their scrutiny of the credit and collections industry. In this CSS Impact–sponsored webinar, experts Vaishali Rao, Jay Williams, and Ari Derman shared strategies for navigating state-led investigations and examinations—whether they start as formal audits or seemingly harmless inquiries that escalate quickly.

The panel stressed that a single consumer complaint—especially tied to politically sensitive topics like medical debt, junk fees, or statute-of-limitations collections—can spark an investigation. State actions are becoming more comprehensive, fueled by increased staffing, former CFPB personnel joining state agencies, and the political and revenue incentives for enforcement.

Emerging focus areas include data privacy, cybersecurity, AI in collections, vendor oversight, technical licensing compliance, and sector-specific debt types such as buy-now-pay-later. States are also paying closer attention to credit reporting practices, even for agencies reporting on a small subset of accounts. While some states adopt CFPB methodologies, each operates under unique rules, making proactive compliance planning critical.

🧠 Key Takeaways:

Treat All Inquiries Seriously – Even informal regulator outreach can snowball into a full investigation. Respond carefully, consider confidentiality protections, and understand when to request formal processes like subpoenas.

Anticipate Hot-Button Issues – Medical debt, junk fees, statute-of-limitations collections, and credit reporting remain high priorities for state AGs. New technology use (AI, telephony systems) and emerging financial products may also draw attention.

Maintain Robust Compliance Year-Round – Use the CFPB’s supervisory manual as a benchmark for internal audits, layering in state-specific requirements. Ensure policies for data handling, vendor oversight, and licensing updates are airtight before regulators come knocking.

By sustaining high compliance standards and staying informed on regulatory trends, companies can reduce risk and be prepared for when—not if—state regulators engage.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN