- AccountsRecovery Daily Digest

- Posts

- Daily Digest - August 1, 2025

Daily Digest - August 1, 2025

Brought to you by: TCN | By Mike Gibb

🎂🎁 Happy Birthday to: Craig Antico of ForgiveCo, Craig Killian of Belco Community Credit Union, Todd Kaus, and Dorian Luna of Quickstop Finance Center.

New Training Bytes Video Published

Check out the newest Training Bytes video! Each week, an expert from the accounts receivable management industry will share how he or she would handle different scenarios that collectors often face. This week, Ryan Thorpe from FFAM breaks down how to respond when a consumer says something like, I got a missed call from this number so I looked online and saw it was for a collection agency. What is this about?” Thanks to Peak Revenue Learning for sponsoring this series! Click on the image below to view this week’s episode!

More than 35 speakers have confirmed for ComplianceCon. Check out who will be speaking and more at Compliance-Con.com.

Collector Sued for Communicating After Being Told Plaintiff Wouldn’t ‘Settle’

A little bit of shameless self-promotion today, because the timing is just too coincidental not to do it … Today’s webinar happens to be on the topic of “How to Parse Disputes, Cease Requests, and Other Vague Comments from Consumers” so you can probably guess what the issues are with this particular complaint, but a collection operation is being accused of violating the Fair Debt Collection Practices Act because it sent a collection letter to an individual after the individual allegedly requested that communications between him and the collection operation be ceased. But, is that what the individual did?

This series is sponsored by WebRecon

A MESSAGE FROM TCN

TODAY‘S WEBINAR

UPCOMING WEBINARS

Appeals Court Affirms Dismissals of Suits Brought by Serial Plaintiff

The Court of Appeals for the Eighth Circuit has affirmed the dismissal of two collection-related lawsuits including one that was brought against a nonprofit operation that buys and forgives unpaid medical debts. The plaintiff has filed lawsuits against more than a dozen creditors and collection operations in the past two years. Both of the affirmations from the Eighth Circuit agreed with the District Court judges that the plaintiff did not have standing to sue in federal court.

More Consumers Are Willing to Work With Collectors, Encore Survey Reveals

Consumers are more financially stressed than ever, but are also more open to working with debt collectors to resolve their debts, according to Encore Capital Group’s 2025 Economic Freedom Study, released this week. The survey, which polled over 6,000 adults in the U.S. and U.K., provides a revealing look into the evolving attitudes consumers have toward debt, credit, and what it means to be financially free.

Bill Targets Overseas Call Centers and AI Use in Customer Service

A new bipartisan bill aims to push back against the offshoring of call center jobs and unchecked automation in customer service — moves that could significantly impact how companies in financial services, collections, and healthcare interact with consumers.

WORTH NOTING: One of the world's largest Buy Now, Pay Later companies says fewer consumers are falling behind on their payments ... Finding qualified talent is still one of the biggest pain points for small businesses ... Senators are calling on healthcare providers to be more upfront with the expected costs of treatment and procedures ... How to help your kids address their anxieties when it comes to math ... The CEO of Goldman Sachs shares advice on taking jobs you may not want and what good can come from it ... A mistake that companies are making when adding AI to their customer service ... A list of 10 movies you should be streaming right now ... Tips to help you prevent and treat insect bites.

Funny Friday, part I

Funny Friday, Part II

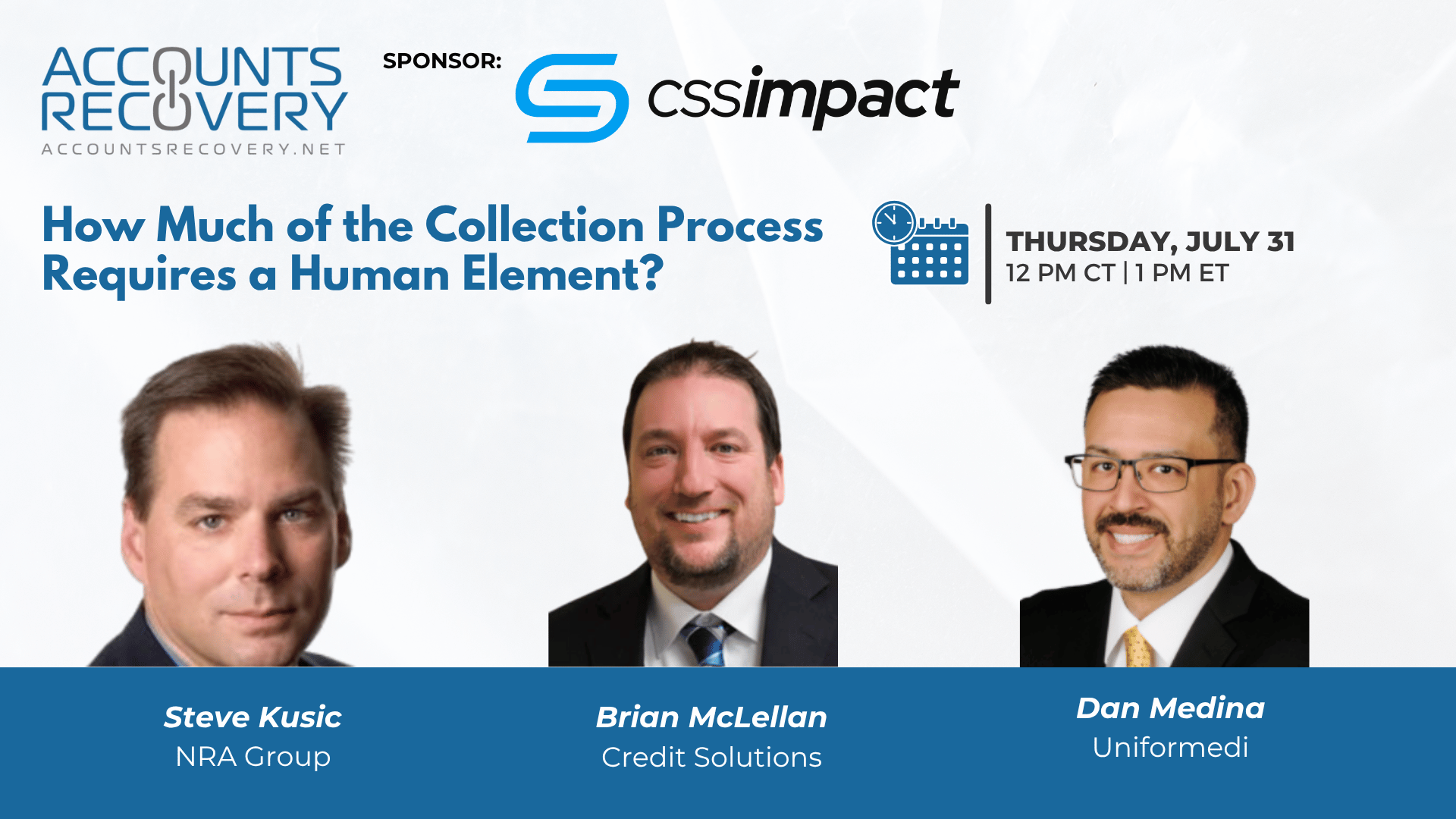

Webinar Recap: How Much of the Collection Process Requires a Human Element?

As collection agencies strive for greater efficiency, many are asking: how much of the process really needs a human touch? In this timely webinar, experts explored the evolving balance between automation and human interaction in collections. While automation—particularly AI, RPA, and large language models—offers massive opportunities for cost reduction and efficiency, there remains a critical need for human oversight and intervention, especially in complex or emotionally sensitive cases.

The panelists shared insights on which tasks are best suited for automation (think: file processing, dispute letter categorization, and daily remits) versus which still demand a human’s decision-making. They stressed that automation should start with repetitive, high-volume, low-complexity tasks, freeing staff to focus on nuanced consumer interactions and compliance-sensitive issues.

But the message was clear: technology is a tool, not a replacement. Oversight, exception handling, and consumer experience must remain central. And with AI costs rapidly dropping and capabilities growing, now is the time to evaluate your systems and processes.

🧠 Key Takeaways:

Start with Low-Hanging Fruit: Identify and automate high-volume, low-complexity, repetitive tasks first—these offer quick wins and visible ROI.

Avoid Over-Automation: Not all tasks can or should be automated. Consumers still expect and sometimes require real human interaction, especially in edge cases or compliance-heavy conversations.

Prepare for Role Shifts: Human roles are evolving—from task executors to automation overseers. Training and restructuring may be needed to adapt to this shift.

With the right mix of AI, process mapping, and thoughtful oversight, agencies can scale operations while maintaining consumer satisfaction and compliance.

To learn more about the technology mentioned, including CSS Impact’s AI virtual agent “Ivan,” visit impactai.cloud or cssimpact.com.

💡 For more events like this, visit accountrecovery.net or register for ComplianceCon—the industry’s only event devoted exclusively to compliance—this September in Nashville.

The Daily Digest is sponsored by TCN